This page contains all the tools I love and use every day. You can always come back and reference it for all your own wealth hacking needs. 😀

I’ll continue adding to this page over time as I come across great new tools that might be helpful to you. I’ll also reference this page frequently in posts and videos, so I definitely recommend you bookmarking or linking to this page for convenience and quick access!

Analytical Tools

Personal Capital is like an industrial grade version of Mint. It’s designed specifically to help investors optimize their portfolios. You hook up all your external accounts (checking, savings, brokerage, retirement, mortgage, credit card) to Personal Capital (with their military / bank-grade encryption protecting all your data) and then the tool starts telling you all kinds of interesting things.

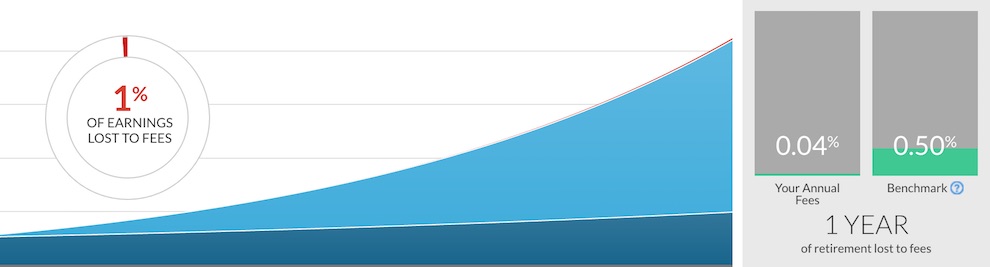

I use Personal Capital for a couple things. One, they have a great Retirement Fee Analyzer tool which helps you clearly see what you’re paying in brokerage and maintenance fees, both in terms of percent of earnings lost to fees and and what that translates to in years of retirement lost to fees. It looks like this:

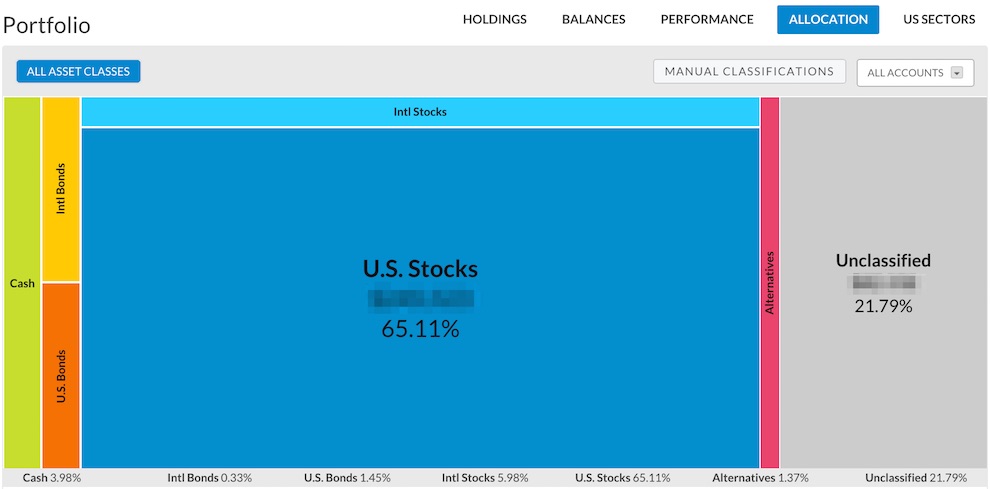

There’s a bunch of line item details I didn’t show in the screenshot that gives you account-level breakdowns. You’ll quickly start rebalancing and moving money around when you find out how much you’re being gouged by certain brokerages or via certain holdings. Two, Personal Capital has a nifty asset allocation “Mekko chart” tool, which lets you see your portfolio allocation like this:

This is really helpful in showing you visually whether your allocations align with your expectations. You can use this to calibrate your annual portfolio re-balancing.

This is what I use to MANUALLY track monthly income, expenses, and net wealth growth. If you want to take total control over your finances and understand how to optimize them like crazy, there is no substitute for rolling up your sleeves and doing the hard analytical work yourself.

My spreadsheet has detailed line items for groceries, eating out, utilities, transportation, healthcare, entertainment, clothing, and more. Tracking these buckets individually has helped us understand our daily “unit economics.”

So, we’re able to understand things like:

- How much do we spend on food each day per person?

- How much do we pay in utilities each day, and what’s the variance between low season vs. high season?

- How much do we pay in gas each day?

- On average, what do we spend on clothing each day?

- How much do we pay in taxes every day?

In the spreadsheet, I also annotate many cells with comments on what specific charges were, what certain line items contain, why items spiked or dipped in certain months. This makes it easy to audit later when I do trend analysis.

I analyze in particular our savings rate because, for us, that’s the most important metric for reaching financial independence.

Portfolio Visualizer provides free analytical tools to help you do backtesting, Monte Carlo simulations, asset allocation optimizations, and analyze regressions and correlations. If you are wonky and like to play around with data and simulations to help inform your investing / wealth-building strategies, use this.

cFIREsim is a free well-known tool to help you simulate returns and portfolio outcomes by entering just a few simple inputs. Or if you want to go deep, you can fudge with 80 different portfolio adjustments, multiple types of inflation, multiple types of market returns, and visually show you all the results.

FIRECalc tells you how big of a nest egg you would have needed to guarantee that you wouldn’t run out of money (by the time you die) given a retirement start date of every year since 1871. This gives you a sense of how safe or risky your retirement plan is, based on how it would have withstood every market condition we faced in modern history.

Brokerage Services

TD Ameritrade. I have several accounts with TD Ameritrade: taxable, IRA, Roth IRA, SEP IRA, Solo 401k. TD Ameritrade has great trading and research tools. No maintenance fees, no minimum balances. Plus, $0 online orders.

I love Vanguard because it’s no frills. The fees are the lowest in the industry because Vanguard has no outside shareholders: Vanguard is entirely owned by its own funds, which are owned by investors like you and me. Since they are not trying to manage quarterly earnings, they don’t need to charge excessive fees, so you get to keep more of your returns. The compound effect adds up over time. If there was only one brokerage I could invest with, I would choose Vanguard. In his annual shareholder letter, Warren Buffett said the same.

Retail Banking

Capital One 360. I use online-only Capital One 360 for banking. Not only is their Allpoint ATM network vast (38k ATMs in pretty much all grocery stores, pharmacies, and convenience stores), but they have all the same services I need from a retail bank: bill pay, direct deposit, wire and ACH services, transfers between checking and savings, CDs, even paper checks.

Tax Filing Prep

I use TurboTax to file my taxes. What I love about TT is its simple Q&A format for doing your taxes. TT walks you step-by-step through income, interest / dividends, deductions, mortgage and business expenses, credits, and special situations to make sure you get the max refund. They have plans tailored to individuals, real estate investors, and business owners — something for everyone.

Disclosure: A few, but not all, links above are affiliate links. That means, at no extra cost to you, I may earn a small commission if you decide to sign up through them. Please understand I have experience with all these tools. I share them here because I proudly use them myself and genuinely recommend them — not because of any small commission I may earn. If you plan to use one of these products and would like to help support this blog, then using these links will do exactly that. It’s win-win, and I greatly appreciate your support.

Can a seller obtain a full homestead exemption from capital gains by selling the home on a land contract that does not transfer the deed until after the end of the second year?

Hi Andrew,

Your “Capital gains on home sale” article is AMAZING.

It feels like you are a world leader on this topic.

I have a complex situation with 2021 home sale that I’d therefore like to consult with you on briefly.

Should I sign up online for the one hour session or is there a more appropriate mechanism

for a short meeting?

Thanks, Alan

Hey Alan, Signing up for a consult is the best way to get meeting time with me. Note that for tax matters related to capital gains on home sales, I can give you my perspective on how I would think about your situation, but it cannot be taken as tax advice or a formal tax opinion because I am not a CPA.