Health Savings Accounts, or HSAs, are the most tax-efficient retirement account in existence.

What?

A health account = retirement account?

Yep.

To explain how, I’ll share a comprehensive set of tips on how to maximize an HSA and integrate it into your retirement planning.

First, we’ll cover some basics: what an HSA is, what the contribution limits are, eligibility criteria for an HSA, what kind of health insurance plans are compatible with an HSA, the main tax benefits of HSAs, and how HSA rules work in general.

Then we’ll analyze strategies for maximizing an HSA’s tax benefits. You can jump to any question below just by clicking on it.

What’s so special about an HSA?

What are the eligibility criteria for an HSA? (You need an HSA compatible health insurance plan)

What are the contribution limits for an HSA?

Special rules for HSA catch-up contributions

Exactly how do I contribute to an HSA?

When is the deadline to contribute?

Do I have to pro-rate my contribution if I start my HSA in the middle of the year?

What are the best strategies for contributing to an HSA?

Wait a sec. I heard HSA contributions don’t shield you from ALL taxes. True?

What are qualified healthcare expenses?

What do I do with my receipts? Do I need to show them to anyone?

What’s the deadline for submitting reimbursements?

What if I don’t use up all my HSA money in a given year?

What if I got my HSA through my employer, and then I leave my job?

What happens to my HSA when I retire?

What if I retire earlier than 65?

What is the best strategy for maximizing returns from my HSA?

You said above there is a “big caveat? What is it?

Just tell me: Is an HSA right for me?

When is an HSA NOT good for me?

Key things to know about your HSA bank’s policies

Because I’m wonky, could you tell me the quick history on HSAs?

What is an HSA?

A Health Savings Account is like a special bank account specifically designed for healthcare expenses. Your money will likely be saved at an actual bank, at least until you invest it.

What’s so special about an HSA?

Money you save in your HSA gets super preferential tax treatment. You put pre-tax money in. You can invest that money in the stock market. The money grows tax-free. If you withdraw the money for qualified healthcare expenses, you pay zero taxes upon withdrawal.

What are the eligibility criteria for an HSA? (You need an HSA compatible health insurance plan)

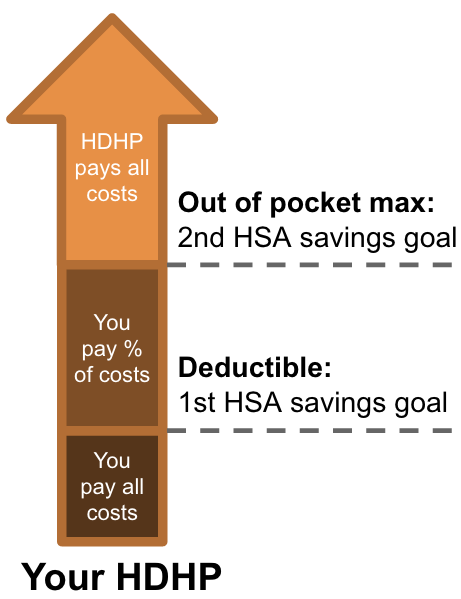

First, you have to be covered under a High Deductible Health Plan. This is a health insurance plan with a higher than typical deductible amount. The IRS defines what qualifies here. Specifically, your HDHP must have a minimum deductible of $1,500 for individuals or $3,000 for families. The max out-of-pocket allowed by law for an HDHP is $7,500 for individuals or $15,000 for families. These figures are for 2023.

Also, you cannot be covered by Medicare or any other health insurance that is not HDHP (e.g., through your spouse), and you can’t be a dependent on someone else’s tax return.

You can buy an HSA health insurance plan on the private market, in most Affordable Care Act health insurance exchanges, and many employers also offer HSA compatible health insurance plan options. Bottom line: they’re not hard to find.

These are the key eligibility criteria, but IRC section 223(c)(1) has an exhaustive list.

What are the contribution limits for an HSA?

The annual HSA contribution limits are:

- Individual: $3,850

- Family: $7,750

- 55+ catch up: $1,000

Special rules for HSA catch-up contributions

First, the catch-up age of 55 is different from the one for retirement accounts, which is usually 50.

Also, you just have to turn 55 by the end of the year: even if your 55th birthday is on December 31, you can still contribute a full extra $1k for the entire year.

If you’re married and both of you will be 55 by end of year, then each of you can contribute an extra $1k. But note that, because an HSA is in an individual’s name, catch-up contributions must be made in your own name. There’s no such thing as a “joint” HSA, even for family coverage. That means if you are 55 but your spouse is not, and your spouse contributes $7,750 for family coverage to an HSA under his / her name, then you’ll have to open a new, separate account under your name for the extra $1k catch-up contribution.

If both you and your spouse are 55 or over, you’ll need two separate HSAs to contribute the max $9,750. There’s no way to do it with just one account.

Lastly, the $1k catch-up is fixed and not adjusted for inflation.

Exactly how do I contribute to an HSA?

Several ways:

- Regular pre-tax payroll deductions from your employer. If you do payroll deductions, you’ll save on BOTH federal taxes AND the 7.65% FICA tax (i.e., social security and Medicare). By contrast, if you do manual contributions, you’ll only get the federal deduction. The FICA deduction is unique because no other retirement vehicle shields you from FICA taxes, so that’s an especially compelling reason to do payroll deductions.

- Online through your HSA bank’s website. This can be one-time or recurring deposits. If you contribute out of pocket, then you’ll take the tax deduction when you actually file your taxes in April.

- Rollover from a prior HSA or IRA. It makes sense you can rollover a prior HSA, but did it surprise you that you can also do it with an IRA? The IRS (under IRC Section 408(d)(9)) allows one IRA to HSA transfer in a lifetime, until you reach the annual contribution limit for that tax year. This allows you to fund an HSA for the year without using current income. Note: if your HDHP changes from individual to family coverage in the same tax year, you can do a second IRA to HSA transfer in that tax year. Transfers from Traditional and Roth IRAs are allowed, but not from SEP and SIMPLE IRAs.

When is the deadline to contribute?

The tax filing deadline (April 15 if not late filing).

Do I have to pro-rate my contribution if I start my HSA in the middle of the year?

Yes. IRS rules state that your HSA contribution limit must be pro-rated according to the calendar year. Specifically, by the number of months you are actually eligible to contribute to an HSA. Your eligibility is based on your health coverage status on the 1st day of the month.

To calculate your pro-rated HSA contribution limit:

- Take the max annual limit and divide by 12

- Multiply by the number of months you are actually eligible

If you were eligible 4 months of the year, your pro-rated limit is: $1,283.33 = $3,850 ÷ 12 x 4.

OK, there’s one exception to the above: the “last month” rule. The last month rule says that if you are eligible to contribute to an HSA on December 1, then you can contribute the entire-year max to your HSA (no pro-ration), AS LONG AS you remain enrolled in an HSA-qualified HDHP through the end of NEXT year. So, if you are eligible on December 1, 2023 and remain in an eligible HDHP through December 1, 2024, then you can contribute the max amount for BOTH 2023 and 2024.

If you switch from individual to family coverage mid-year, you can contribute the entire-year family max as long as you maintain family coverage from December 1 this year through December 31 next year.

If you do the opposite and switch family to individual coverage mid-year, you can contribute more than the individual max but less than the family max. Simply:

- Pro-rate based on the number of months of individual coverage

- Pro-rate based on the number of months of family coverage

- Add the two pro-rated amounts

So, if you changed your coverage from family to individual on July 1, you’d calculate your max contribution as: (6 x individual coverage monthly rate) + (6 x family coverage monthly rate).

What are the best strategies for contributing to an HSA?

There are three strategies:

- Save enough to cover what you spent on healthcare last year. This works well if your healthcare expenses are predictable and recurring. If you’re gonna spend it anyway, might as well do it tax-free ‘cause that’s just free money in your pocket. To estimate this, just look across all your claims statements, explanations of benefits, and bills and receipts to tally up how much you spent last year.

- Save based on your HDHP deductible and maximum. You can save just enough to cover all your out of pocket costs before your HDHP picks up the rest. This ensures your first few thousands bucks of out-of-pocket medical are tax-free, not just the part above the 10% AGI threshold.

- Save enough to cover anticipated expenses. If you know approximately what you’ll spend in the coming year on healthcare, you can plan around that. Maybe you need non-urgent surgery, or are planning a pregnancy, or want Lasik. You can save for major anticipated expenses and get price estimates from your health insurance provider, Healthcare Bluebook, or just by Googling.

HSA tax benefits

Here is why:

Quite simply, it’s because HSAs never get taxed.

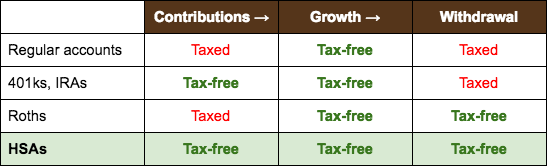

Regular accounts get taxed twice: on contribution and on withdrawal. Dividends also technically get taxed along the way. If you’re lucky, you’ll get capital gains tax rates on withdrawal, but either way, you’s gonna get taxed.

401ks and IRAs use pre-tax dollars going in, but get taxed all as ordinary income on withdrawal.

Roths get taxed going in since you’re using post-tax dollars, then are tax-free on withdrawal.

HSAs are like magic. They skip the tax system altogether. You keep every dollar you contribute.

Of course, the big caveat is, you can only use the funds for qualified healthcare expenses. But c’mon, you are GOING to have healthcare expenses, sooner or later. No matter how healthy you are. It’s a certainty, just a matter of when.

And don’t be scared by the word “qualified.” It’s pretty darn generous. Just check out what’s allowed below.

Wait a sec. I heard HSA contributions don’t shield you from ALL taxes. True?

OK, smarty pants. True. This is a caveat to the above.

While you can always deduct at the federal tax level, you can only sometimes deduct at the FICA and state level.

You’ll only get the 7.65% FICA tax deduction (a unique feature of HSA contributions) if you contribute through employer payroll deductions.

State tax deductions are only available in certain states.

You DO get a state tax deduction in these states:

- Arizona

- Arkansas

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

- Virginia

- Vermont

- West Virginia

- Wisconsin

You do NOT get a state tax deduction in these states:

- Alabama

- California

- New Jersey

These states don’t even have state income tax, so there’s no HSA tax benefit to be had anyway:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Finally, these states tax HSA earnings, but not original contributions:

- New Hampshire

- Tennessee

What are qualified healthcare expenses?

Qualified healthcare expenses are generally any expenses that would have been eligible for the medical or dental expenses deduction, plus expenses for prescription drugs. They include insurance premiums if you’re on a COBRA plan or if you’re receiving unemployment benefits. They also include Medicare (not Medigap) premiums and long-term care insurance (subject to deduction limits).

Examples of qualified expenses:

- Acupuncture

- Alcoholism treatment

- Ambulance services

- Artificial limb or prosthesis

- Artificial teeth

- Birth control pills

- Braille books/magazines (portion of costs)

- Car adaptations (for persons with disabilities)

- Chiropractors

- Christian Science practitioners

- Contact lenses (including saline solution and cleaner)

- Crutches

- Dental treatment (x-rays, fillings, extractions, dentures, braces, etc.)

- Diagnostic devices (such as a blood sugar test kit)

- Doctor’s fees

- Drug addiction treatment

- Eyeglasses (including eye examinations)

- Eye surgery (including laser eye surgery)

- Fertility enhancement (including in-vitro fertilization)

- Guide dog (for visually-impaired or hearing-impaired)

- Hearing aids and hearing aid batteries

- Hospital services (including meals and lodging)

- Insulin

- Laboratory fees

- Lactation assistance supplies

- Prescription medicines or drugs

- Nursing home

- Nursing services

- Operations or surgery

- Psychiatric care

- Psychologist

- Telephone equipment for hearing-impaired

- Telephone equipment for visually-impaired

- Therapy or counseling

- Transplants

- Transportation for medical care

- Vasectomy

- Wheelchair

- X-rays

Examples of NOT qualified expenses:

- Acid controllers

- Allergy and sinus medications

- Babysitting, childcare, and nursing services for a normal, healthy baby

- Controlled substances obtained in violation of federal law

- Cosmetic surgery

- Cold, cough, and flu medications

- Dancing lessons

- Diaper service

- Electrolysis or hair removal

- Funeral expenses

- Hair transplant

- Health club dues

- Household help

- Illegal operations and treatments

- Maternity clothes

- OTC medications (without a doctor’s prescription)

- Pain relief medications

- Personal use items

- Sleep aids and sedatives

- Swimming lessons

- Teeth whitening

- Vacation or travel

- Veterinary fees

- Weight loss programs for improvement of appearance, general health and wellness

How does reimbursement work?

You can spend from your HSA / get reimbursed in few ways:

- Debit card. Your HSA bank will issue you an HSA Visa debit card. It’ll look and act just like a credit card. Swipe at purchase and it’ll deduct directly from your HSA, no reimbursement needed. You’ll actually need the funds in your HSA before you can spend it, just like a checking account. You can’t swipe if the funds aren’t there.

- Withdraw from ATM. You can withdraw from the ATM of your HSA bank and spend it that way. Same as above, the funds must exist before you can withdraw. No reimbursement, since you’re withdrawing directly from the HSA.

- Online bill pay. You can use online bill pay on your HSA bank’s website to pay healthcare providers electronically. Same as above, the funds must exist in advance, no reimbursement.

- Pay first, reimburse later. Pay out of pocket first, then reimburse yourself from the HSA later. Your bank won’t ask for receipts; they’ll reimburse you no questions asked. But you should keep your receipts in case the IRS audits you.

What do I do with my receipts? Do I need to show them to anyone?

No. You should keep your receipts, but no one other than the IRS will ask to see them. Your HSA bank will reimburse your health expenses without them. The IRS may ask for your receipts if you get audited, but you aren’t required to submit them anywhere.

What’s the deadline for submitting reimbursements?

There is none. You can reimburse yourself for qualified health expenses anytime, even months, years, or decades in the future. Just be sure to keep your receipts in case the IRS audits you.

What if I don’t use up all my HSA money in a given year?

Any remaining funds carry over indefinitely. Unlike a Flex Spending Account (FSA) which you lose anything above $500 if you don’t spend it during the tax year, your HSA carries over forever.

So, if you’re healthy, don’t need much healthcare, and have leftover HSA money at the end of the year, you can keep saving it and saving it for future needs. It’s essentially a healthcare rainy day fund.

What if I got my HSA through my employer, and then I leave my job?

Any HSA money you’ve contributed is yours, and stays yours, even when you change jobs.

What happens to my HSA when I retire?

Once you turn 65, you can use the funds for ANY purpose without penalty, but any amount you don’t use on qualified healthcare expenses will get taxed at ordinary rates, just like IRA money. Effectively, your HSA turns into an IRA after 65, just with the added benefit that healthcare expenses are tax-free forever and there are no required minimum distributions.

What if I retire earlier than 65?

You can still use your HSA funds fully tax-free for healthcare expenses. But you’ll get slapped with a 20% penalty (on top of getting taxed) if you use that money for anything else before you turn 65.

Just use your HSA for healthcare, and use your other savings accounts / Roth ladder money / dividends / whatever for everything else and you’ll be good.

What is the best strategy for maximizing returns from my HSA?

At a high level, it’s:

- Max out your HSA contribution every year

- Invest the money in low-cost equity index funds

- Let it grow tax-free for decades

- Don’t spend a dime of it for as long as you’re reasonably healthy, to give maximum uninterrupted runway to grow the HSA

- After retirement (or when your health declines) use the HSA to pay your healthcare-only expenses

- Use other retirement accounts to pay your non-healthcare expenses (living / leisure costs)

Indeed, when you combine an HSA with a 401k / IRA / Roth ladder combo, you can get some truly magnificent tax savings.

The overall idea behind this strategy is that, since there is no “use it or lose it” concept for HSAs like there is for FSAs, you can invest your HSA and let it grow uninterrupted for a very long time and then use it only when you really need it.

Why wait so long to spend it?

Because the average retired couple needs $315k in healthcare expenses in retirement, according to this year’s annual Fidelity Retiree Health Care Cost Estimate. Retiree health expenses often exceed $500 per person monthly, and most of these costs are HSA-eligible.

These figures are all higher in 2020, too. 25 years from now, inflation alone will double costs, and it’s no secret that healthcare costs have risen much faster than inflation in recent decades. Check the Kaiser Family Foundation’s interactive healthcare spending tool.

There’s a good chance prices will more than double by the time you actually need serious healthcare. Be warned.

If you’re thinking: “Hey, I have some medical expenses right now. Why not use the HSA now?” You’d be raising a good point. A bird in the hand is worth two in the bush, right?

Yes, except for the fact that diversified stocks reliably outperform other asset classes over long periods of time, i.e., decades. And long-term stock returns + uninterrupted compound interest will pretty much beat any immediate use of your HSA money right now.

The “uninterrupted compound interest” part is key: it means you leave a long enough runway for your money to earn more money.

So, if you can keep contributing to your HSA, invest the money in stocks, and never withdraw until you REALLY need it for healthcare expenses (delaying this for as long as possible by eating healthy and exercising and paying minor medical costs out of pocket during your younger healthy years), then you’ll end up with a LOT more money over a long period of time than you would by simply contributing and spending down every year.

That’s ‘cause when you spend down your HSA every year, your purchasing power is ONLY amplified by the tax deduction alone.

By contrast, when you invest and compound your returns, purchasing power is amplified by BOTH the tax deduction AND compounding. As long as your investment returns outpace inflation (which has always been true for stocks over a long period of time), you’ll end up with more dollars than you saved. The longer the horizon, the bigger that gap. A good thing!

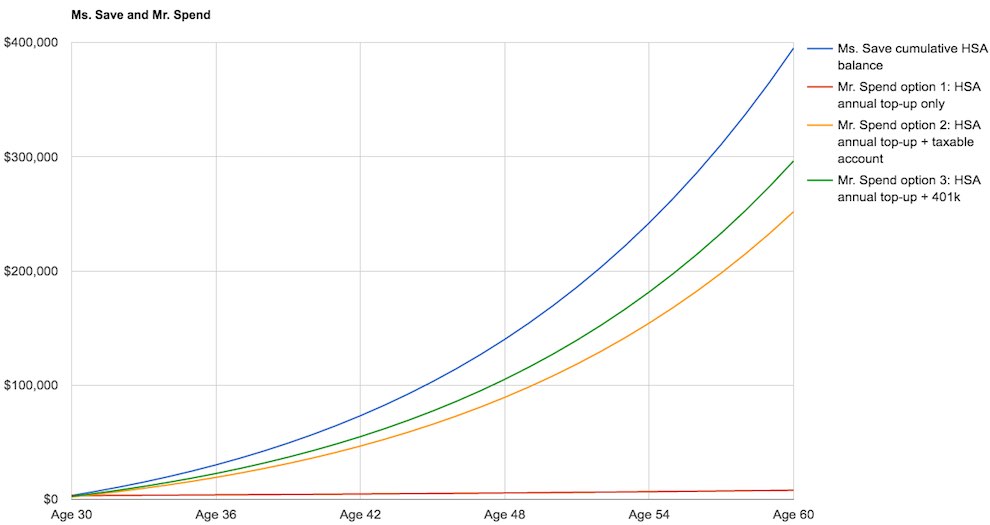

Here’s a chart to show how the gap increases over time.

Assumptions:

- Both Ms. Save and Mr. Spend max out an individual HSA every year

- Both have identical health costs throughout their lives

- Both just turned 30 years old

- Both have an all-in marginal tax rate of 25%

- Inflation rate = 3% annually forever

- Growth rate on diversified stock index fund = 6% annually forever

- Key difference: Ms. Save lets her HSA compound uninterrupted and pays medical costs out of pocket until she turns 60. Mr. Spend spends his entire HSA every year on healthcare and then either invests the money he would have otherwise had to use on healthcare in another retirement account, like a 401k or taxable brokerage account, or blows it on consumption

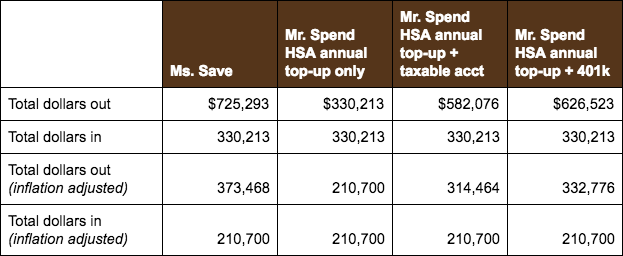

And here’s how Ms. Save and Mr. Spend net out in terms of “money in” vs. “money out” in the end:

We assume both have identical healthiness, expenses, and investment returns. We also assume the taxable account uses after-tax dollars and is ultimately subject to 15% capital gains taxes while the 401k uses pre-tax dollars and is ultimately subject to 25% ordinary taxes.

As you can see, Ms. Save ends up with $100k more ($40k more inflation adjusted) after 30 years vs. Mr. Spend’s “best” option (HSA annual top-up + 401k), entirely because of taxes. If Mr. Spend blows the money on consumption that he would have otherwise had to use on healthcare (but for the HSA), he ends worst of all: only having exactly what he put in and not getting any compounded returns.

And what if you’re lucky and have very low health expenses in old age due to your good genes? Is all this money invested “wasted” in a sense?

Well, remember you can always reimburse yourself for a lifetime of past out-of-pocket medical expenses (no deadline for reimbursement), as long as the expenses occurred after your HSA was established and they haven’t already been reimbursed or deducted previously. (Remember to save your receipts in case you’re audited.)

For max tax efficiency, in what order should I contribute to my retirement accounts, and where does an HSA sit in that order?

The exact order I recommend to max out your accounts, subject to a BIG caveat explained below, is:

- 401k up to employer match

- HSA

- IRA (only if your income level doesn’t disqualify you from the tax deduction)

- Remaining employer 401k

- Solo 401k employer contribution (if you have side hustle income)

- Backdoor Roth using after-tax IRA

Couple things.

- Notice there’s no Roth contribution here other than the backdoor method. That’s ‘cause we want to avoid taxes at the point of contribution. We’ll still use a Roth for its withdrawal tax advantage, but we’ll ladder over funds strategically only after retirement (or after we have an intentionally timed reduction in income) when our tax bracket drops.

- Why do we rank an IRA higher than remaining employer 401k? Because your 401k most likely does not have as good or wide a selection of investment options and is likely also charging you an annual administrative fee. By contrast, IRA accounts usually have much wider access to stocks, options, bonds, mutual funds, etc, whereas 401ks may only have access to a few mutual funds or bond funds. IRA accounts also usually cost nothing to maintain.

You said above there is a “big caveat? What is it?

It is this: Sometimes it is actually better to contribute to an HSA even BEFORE contributing to a 401k up to employer match. Because sometimes you net more dollars by contributing to the HSA before anything else.

How is this possible?

This is possible, and in fact especially relevant, when two conditions are true.

First, you don’t anticipate any material health expenses in the coming year, i.e., you’re fit as a fiddle. In this scenario, you can think of an HSA simply as yet another retirement account. An account whose spending purpose is singularly focused on medical expenses, but a retirement account nonetheless.

Second, your employer match falls below a certain threshold and your future tax bracket (in retirement) is expected to be above a certain threshold. When this is true, the tax advantage of an HSA is so powerful vs. any other type of account that it is actually more profitable to prioritize it first, even over a 401k with an employer match.

Let’s illustrate with an example. Say your 401k has a 25% match. You expect your marginal tax rate during retirement to be 20%. If you put $1 pre-tax in your 401k, you’ll get $1.25 because of the employer match. However, when you withdraw, you only get $1 back because you owe 20% taxes on the withdrawal. That’s the same as simply contributing $1 pre-tax to an HSA, provided you spend it on healthcare, since you’d also get $1 back on withdrawal.

It’s now easy to see in this example that, if your employer matches less than 25% or you expect your tax rate in retirement to exceed 20%, then it’s actually a better deal to contribute to the HSA over the 401k despite the employer match.

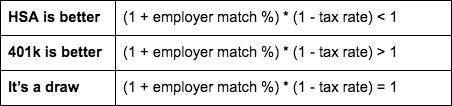

If you want to determine whether it’s better to prioritize funding an HSA vs. 401k, just use this simple formula:

If it’s a draw, or even if it’s just slightly better one way or the other, then it’s wise to consider additional factors:

- The HSA can only be used for health expenses if you want tax-free treatment in and out

- The 401k can be withdrawn penalty-free at 59.5, but for the HSA it’s 65 (health expenses are tax-free anytime)

- The 401k has mandatory distributions starting at 72; the HSA doesn’t

- You can rollover a 401k to an IRA, then ladder over to a Roth, but you can’t do that with an HSA

- Your investment options may be better in one account vs. the other

This chart shows what’s better to prioritize higher — HSA or 401k — given various employer match rates and future expected tax rate combos.

You can also check out an interesting article Greg Geisler wrote in the Journal of Financial Planning called Could A Health Savings Account Be Better Than An Employer Matched 401(k), but the key insights are already summarized above.

Just tell me: Is an HSA right for me?

Given the tax benefits, HSAs are a particularly good choice when any of the following are true (doesn’t have to be all of them):

- You and your dependents are healthy and only need routine office visits, few or no prescription drugs and don’t expect major medical expenses

- You’re able to pay your full deductible and out-of-pocket expenses using your HSA

- You want to save pre-tax dollars for future health expenses

When is an HSA NOT good for me?

An HSA may not be good for:

- Heavy users of medical care. If you have a LOT of healthcare expenses, you should probably go with a traditional, lower deductible / lower out of pocket max plan, not an HDHP. You don’t want to skip necessary healthcare because the deductibles are too high.

- Non-savers. If you don’t save much for retirement right now, it’s probably worth saving in an employer-matching 401k first before starting an HSA, at least up to the match amount. You don’t have to max out your 401k before opening an HSA (and you probably shouldn’t), but you should at least contribute enough to get the employer match. In later years, you can do a Roth ladder to make sure withdrawals come out tax-free. Remember, your HSA can only be used tax-free for health expenses. But a 401k that’s laddered over to a Roth can get tax-free treatment for ANY expense.

Any other tips?

A few:

- Penalties. If you use HSA money for non-qualified expenses, the withdrawal is not only taxable as ordinary income, you’ll also get slapped with a 20% penalty. But that penalty is waived once you turn 65, are disabled, or you’re withdrawing as a beneficiary after the original HSA owner’s death. A surviving spouse can even continue an unused HSA in her own name and get tax-free treatment on all the funds; this spousal rollover is similar to those in other retirement accounts.

- Preventative care. You should know that, for many HDHPs, preventive care is often covered 100%, no deductible (zero cost to you), if the services are received from network providers. After all, it’s everyone’s interest for you to stay healthy, and Congress didn’t want HSAs to deter people from getting basic checkups. So make sure you schedule regular medical and dental checkups!

- Contribution limit is based on your HDHP. If two spouses each have individual HDHPs, they cannot contribute the family max to just one person’s HSA. They can only contribute the individual max to each of their separate HSAs. If they want to contribute the family max, they must first be covered under a family HDHP policy.

Key things to know about your HSA bank’s policies

- You’ll probably be charged a monthly account maintenance fee. It won’t be much (and often is paid by your employer), but since you can’t contribute more than a few thousand per year to an HSA in the first place, it’s something to be aware of. Your HSA bank may also waive this fee if you meet a certain balance threshold in the account.

- Your HSA bank may require a minimum cash balance. That is, before you can invest in stocks, mutual funds, etc. Anything above and beyond this min balance can be invested. Also, if you fall short of this cash balance at any point, your HSA bank probably won’t liquidate your investments to top up your cash balance, but any future contributions may have to be applied first to topping up before more investing is allowed.

- Your investment options will probably be more limited than your brokerage account. For example, you may only have the option to invest in a handful of mutual funds. If your HSA is really good, you might get to invest in stocks. Either way, you won’t have a ton of options, and you should also be aware mutual funds do charge higher fees and expense ratios. So you’ll have to consider whether your HSA investment options are worthwhile. I believe that, especially if you’ve already maxed out other accounts and you’re healthy (no major health expenses anticipated), it’s still worth the tax-free in, tax-free out investment growth. Even though such growth may be lower than what you can get from stocks or ETFs, some investment growth, despite the fees, is still better than no-growth cash sitting in your account.

- If you leave your HSA bank / roll out your funds, avoid the hefty fees. Your HSA bank will probably charge you something stupid. You can avoid this by just withdrawing all the cash (but not closing the account yet), then depositing the cash at your new HSA bank, then going back to close the account at your old bank. (Remember, they’re not extending you credit, so there’s no penalty for not paying.)

- When you leave your HSA bank, you may need to cash out your investments. Your HSA bank may not allow a direct outbound rollover, so you should check before deciding on an HSA bank or making investments. Some do, some don’t.

Because I’m wonky, could you tell me the quick history on HSAs?

Sure…just for you! The HSA was established as part of the Medicare Modernization Act of 2003. Its purpose was to help lower the cost of healthcare by reducing overinsurance, because overinsurance incentivizes excessive use of healthcare.

Basically a bunch of healthcare analysts thought overinsurance was driving up healthcare costs, and if patients were given better incentives and footed more of the bill, then costs would decrease.

So, Congress created the HSA and paired it with the High Deductible Health Plan. With an HDHP, patients paid lower upfront premiums in exchange for higher deductibles, and HSAs provided relief for these higher deductibles through tax incentives.

Closing thoughts

You’re gonna need healthcare when you’re old. No way around that, friends. It’s one of the few inevitable expenses, and the amount you’ll need could vary tremendously depending on your genes, lifestyle habits, and luck.

Anyone saving for retirement will have to plan rainy day funds for healthcare, alongside their other retirement goals. So separating your retirement savings into 2 buckets — healthcare going in an HSA and all other going in a 401k/IRA — is by far the most tax-efficient way to save for retirement and end up with the greatest number of dollars possible come time to withdraw.

If you need a “rule of thumb,” contribute to your retirement accounts in the following order and you’ll be good:

- 401k up to employer match

- HSA

- IRA (only if your income level doesn’t disqualify you from the tax deduction)

- Remaining employer 401k

- Solo 401k employer contribution (if you have side hustle income)

- Backdoor Roth using after-tax IRA

Be sure to also check out our related podcast episode on medical billing and health insurance claim lookups to make sure you – and your HSA – don’t get overcharged for healthcare.

What about you? Do you have an HSA? What investment options does your HSA bank provide? What tips have you found for maximizing the returns from your HSA? Leave a comment below and let me know!

Excellent post Andrew! Well-written and thoroughly-researched. A cool hack (aka Super-HSA) applies when there’s an adult child (<age 26) still on the family's HDHP but is no longer a tax dependent.

Since distributions from the family HSA for the adult child’s medical expenses are no longer qualified distributions, the child is permitted/required to fund his/her own HSA.

And since the child is on a family HDHP, he/she qualifies for the family max $7,300 ($7,750 in 2023). This hack is known as the Super-HSA!

sources: IRC 223 & IRS Pub 969 Health Savings Accounts and Other Tax-Favored Health Plans.

Thanks for the tip!

Forget the health savings account if you are Medicare eligible even if you haven’t started Part B. The tax consequences will be a big surprise. You will need to stick with a flexible spending account since Medicare renders you ineligible to contribute to your HSA.

Very thorough post. Thank you! Last year was my first year maxing out an HSA. I will continue to max it out annually. I invest the money above the required $2,000 that must remain in cash. I like the tax advantages of it and hope in retirement more and more items qualify to use the funds if needed.

Great post! I am in <3 with my HSA! I just switched from a low deductable plan to the HSA at the start of this year. Our company gave bonus incentives to choose it ($400) and I just reached the minimum analogy needed before I can invest. Looking forward to throwing it all in index and see what happens. My favorite point of the HSA (besides I don't have to use it or lose it) is I can use it as an ATM so to speak. Whatever qualified medical expenses I have now, if I save the receipts I can pay myself back at any time…even years from now! Just turn in the receipt and they will fork over the cash. Love it!! 🙂

That’s great – yep HSAs provide some amazing tax benefits!