I live in the San Francisco Bay Area and housing prices are going bonkers right now.

Many would-be buyers either cannot afford to buy here at all, or can’t justify paying the astronomical prices here even though current rents are also insanely high.

Heck, even houses with dead corpses inside are selling for over $1.5 million, more than 50% above asking.

In this post, I’ll show you how I have made buying a home in the Bay Area pay off handsomely.

And if you also live in a high-growth real estate market, you may be able to incorporate some of the same learnings to analyze whether investing in real estate can pay off for you, too.

Why the math shows buying was better than renting — get ready for some nerdy finance

I bought a home in the San Francisco Bay Area in the fall of 2012. And because my purchase was on the early-ish side of a spectacular growth curve that has occurred (and is still continuing) in the 3 years since, the investment has paid off. It has definitely been better to own than to rent.

How do I figure that owning has been better than renting?

Simply because my costs have been less than what I would have paid as a renter.

To no credit of my own, I also got lucky in terms of timing my home purchase, and my upside returns have been better than the overall stock market as well.

Here’s how the math works.

Right now, I pay 3.625% on my mortgage. You should think of mortgage interest as nothing more than rent on a loan.

But mortgage interest is also tax-deductible. By paying mortgage interest, you’re basically enjoying government-subsidized rent.

So my 3.625% interest rate is really more like 2.5375% after the tax deduction (assuming an effective tax rate of 30% for simplicity).

By contrast, the annual “dividend” I collect in the form of rent on my property is currently 6.0136%.

Where did I get this 6.0136%? I computed it as:

I take the monthly rent I collect and annualize it. Then I divide that by the total home purchase price, which consists of both home equity and mortgage balance outstanding. That amount is the annual rental dividend.

You can also think of this as the gross return on total invested capital (before costs and taxes).

Right now, paying 6.0136% of the home price every year for the privilege of renting is more costly than simply buying the house outright.

In fact, when I think about the rent I pay right now for my little 1-bedroom apartment (because I had to rent a place to live in after renting out my own house), the implied value of the apartment building I live in, using the same 6.0136% annual rental dividend rate, is $3.6 million.

That’s crazy!

I know for a fact from public sales data that this apartment building just sold less than 1 year ago for exactly $3 million.

The value of the building did not somehow just magically jump 20% in less than a year.

So that gap between what it actually sold for ($3 million) and the implied price of $3.6 million when you assume a 6.0136% annual rental dividend is basically the “tax” I pay for being a renter, rather than an owner.

And unlike owners who enjoy a mortgage interest tax deduction, there is no tax deduction for renting.

In a way, the government is basically punishing renters, who are often poorer than owners, by making them pay more. Which sucks.

But if you’re the property owner in this scenario, you’re sitting pretty. That excess rent is incremental net wealth you’re building.

Uh, aren’t you forgetting some costs of owning a home?

Wait a minute, you say. Doesn’t homeownership come with other costs besides mortgage interest?

For sure. There are some big-ticket items like property taxes, insurance, HOA dues, and maintenance — plus hassle.

You’re exempt from all these as a renter, right?

Not really. You just end up paying for them in cash in the form of high rents.

Let’s break down all these other costs to see how they offset rental income:

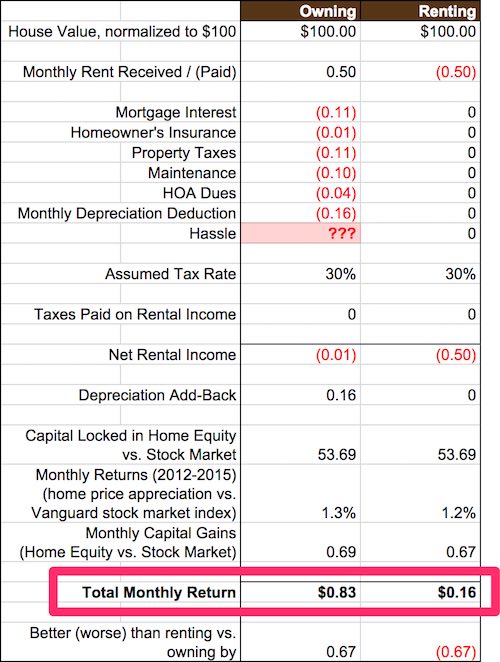

I hope you didn’t just barf looking at that.

Here’s what’s going on.

I took two scenarios, owning vs. renting, and split them into 2 columns.

The columns analyze the economics of owning vs. renting on a “normalized” basis — that is, they show what the economic gain and loss is for every $100 of house value.

What are the economics of owning?

In the left column, which analyzes the economics of owning, we see that for every $100 of house value, I am currently collecting 50 cents of rent each month.

From that 50 cents, I pay each month:

- 11 cents in mortgage interest (before taking the tax deduction)

- About a penny in homeowner’s insurance

- 11 cents in property taxes (paid annually, but amortized here to show the monthly cost)

- 10 cents in maintenance and renovation costs (I summed all the maintenance I’ve done since Day 1 and averaged it across all the months I’ve owned the house)

- 4 cents in HOA dues

By the way, I only count mortgage interest and not mortgage principal in this analysis, because mortgage principal simply gets added to my home equity. I still own it at the end of the day. So it’s not actually an expense. It’s just converting it from one format (dollars in my wallet) to another (dollars in my home equity).

Whereas mortgage interest is a true expense that’s the “rental price” of borrowing money in the first place. (As in, I’ll never see those dollars again.)

On top of the costs above, I also take a deduction of 16 cents a month as a depreciation tax shield.

That’s because The IRS lets you depreciate the home value (but not the land value) of a rental property over 27.5 years and offset that depreciation against rental income.

It’s “funny money” because there is no cash flow involved. It’s just a shield against taxes by letting you reduce your taxable income on paper.

So for every $100 in home value, each month I get to take 16 cents of depreciation to offset the 50 cents of rental income I collect. That lowers my taxable income by that much.

Lastly, there is also an unknown cost of bearing the hassle of owning a home — having to file property taxes, coordinate contractors when maintenance is required, attend HOA meetings, etc. It’s not clear what the financial cost of that hassle is, because it’s mostly paid with my time. But I’m going to circle back to this later after we have a clearer picture of the other economics.

I assume my effective tax rate is about 30%.

I actually pay zero taxes on my rental income, because the combined costs plus the depreciation deduction exceed my rental income. (You can check out my income and expense write up which includes more detail about how taxes on rental income can possibly be zero.)

In fact, on paper, I actually lose a penny per $100 of house value each month because my costs exceed my rental income.

In reality, though, the depreciation deduction is a non-cash charge, so I actually do receive the cash flow from it: all 16 cents.

Meanwhile, for every $100 of house value, I currently have $53.69 locked up in the home equity of my house. That certainly has an opportunity cost, because if I didn’t own this house, I could be using that money to invest in the stock market and get a nice return, with more liquidity I might add.

But how much, really, has the opportunity cost been?

After all, home prices have risen since I purchased the home. By how much?

By estimating what I’m very confident I could sell the house for today based on aggregate month by month median sales data from Zillow reflecting home price appreciation for my exact neighborhood, I was able to compute the monthly geometric mean growth rate from the month I purchased the home to the present day.

For my exact neighborhood, even after I assume a double-percentage point haircut off Zillow median sales data (let’s say, for instance, I needed to liquidate the house urgently and had to take a price hit to do that), I still estimate that the monthly growth rate in home price appreciation is 1.3%, which actually outperforms the monthly 1.2% rate of return of Vanguard’s total stock market index ETF (VTI).

So, off a home equity base of $53.69 for every $100 of house value, my capital gain on home equity for the past 3 years has been 69 cents every month.

Adding this 69-cent return to the 16 cents of cash flow from adding back the depreciation tax shield above, then backing out the penny loss on my rental income, results in a total monthly return for owning (and renting out) my home of 83 cents per month. Again, this is for every $100 of house value.

Is your brain hurting yet?

I promise the rental side of the equation is way simpler. 🙂

What are the economics of renting?

It’s simple. For every $100 of house value, my tenant pays 50 cents a month in rent.

My tenant pays no mortgage interest, homeowner’s insurance, property taxes, maintenance or repair costs, or HOA Dues, and also bears no hassle of owning or upkeeping the home.

Assuming the tenant had the capital to pay the $53.69 of home equity for the house, but decided instead to rent, and then invest that capital into the stock market instead, they would have enjoyed a monthly return over the last 3 years of 1.2% each month.

This assumes they aren’t professional stock pickers and they just invest in the cheapest benchmark fund out there that matches overall market returns: Vanguard’s total stock market ETF (which I mentioned above).

That translates to a capital gain of 67 cents per month.

You can already see that renting is the losing proposition.

Not only does renting mean kissing goodbye to cash totaling half a percent of the house value every single month, it has also equates to earning less capital gain in the stock market each month compared to the home price appreciation that’s been so strong and consistent in the San Francisco Bay Area over the last half decade.

Total returns to the renter in this scenario are 16 cents a month, compared to 83 cents a month for the owner.

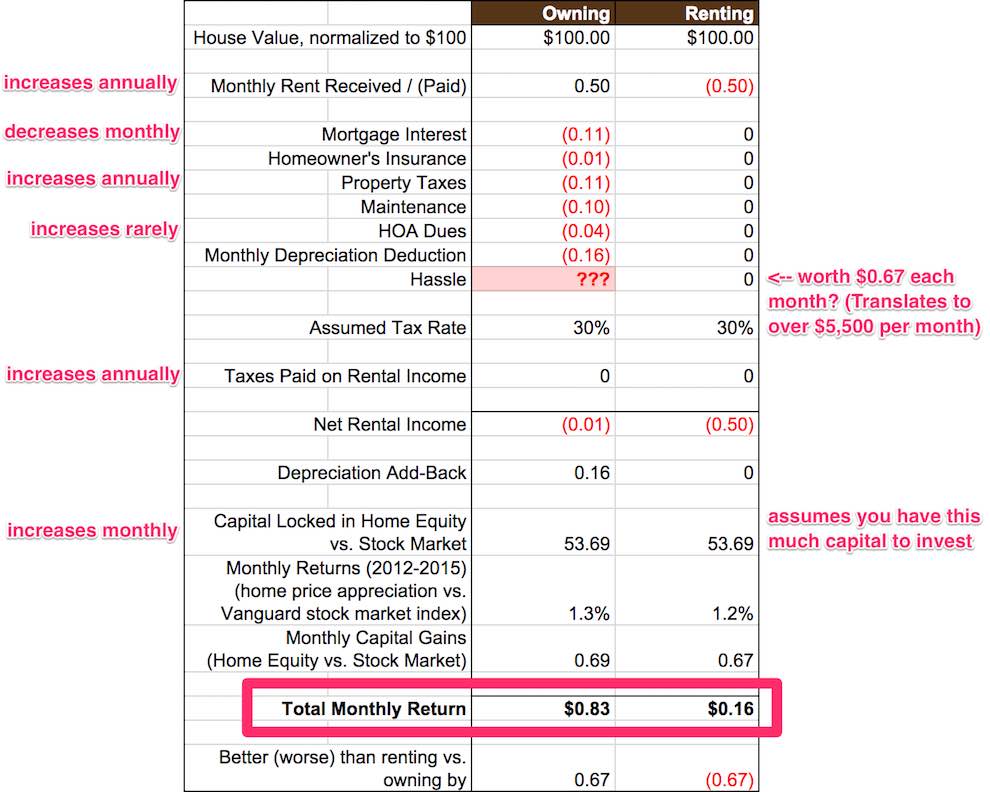

But there’s more: the owning scenario gets even more attractive over time

The owning scenario is already more profitable as of now, but over time it will get even better.

That’s because mortgage interest as a percent of the entire mortgage payment will decline with every single monthly payment, as mortgage principal comprises an ever greater share.

Moreover, rents will generally keep rising each year as demand increases and overall prices rise.

Of course, to be sure, these favorable shifts will also be offset by annually increasing property taxes (as your tax basis often gets raised each year). However, municipal government is not generally in the business of being a profit center, and the tax basis in my city has only increased an relatively anemic 0.8 percent per year, compared to the current home price appreciation velocity of 1.3% per month.

HOA dues will also increase periodically, though less frequently.

Here is the same own vs. rent breakdown analysis, annotated with line items I expect to systematically increase or decrease over time:

The biggest changes will be rent, mortgage interest, and property taxes. Rent and mortgage interest tailwinds combined should exceed property tax headwinds.

Is the hassle worth it?

This brings us back to the question of hassle raised earlier.

Even if it makes economic sense to own a home, is it worth the hassle?

You have to deal with the tax man, coordinate repairs and maintenance, do HOA stuff, and fix things around the house.

How should we think about hassle when it’s mostly paid with time?

Ultimately, hassle is hard to quantify financially, and tolerance for it is a personal choice.

In my case, my home doesn’t actually often give me much trouble in the first place, but when it does I actually partially see it as a “benefit” that gives me the opportunity to learn important details of home maintenance and home improvement projects and how to be handy around the house (with help from my friend, the YouTube).

Even though dealing with it can feel hasslesome and time-consuming in the moment, I do learn things from the experience and become more capable — and sometimes even <blog about them here>!

For me, taking care of something and fixing it when it needs attention is just part of the bargain of owning anything. It’s no different for a house than it is for a car or a television or a pet.

Not owning a home frees you from this hassle but restricts you in other ways. You can’t redecorate as you’d like, you often can’t have a pet, and eventually you’ll probably get your rent jacked up or your lease may be terminated.

So, as far as hassle goes, I think the benefits / tradeoffs of owning vs. renting cut both ways.

Financially, the simplest way I look at it personally is this: My analysis shows that the renter avoids hassle at a financial cost of 67 cents per month, for every $100 in house value.

That 67 cents is the difference in total monthly return between owning vs. renting — the difference between 83 cents a month for owning vs. 16 cents a month for renting.

For me, that “normalized” amount of 67 cents actually translates to more than $5,500 every month and more than $65,000 a year in actual dollars.

Maybe one day I’ll have hacked enough wealth to not care about blowing $5,500 a month avoiding hassle.

But until then, bring on the hassle!

Related: Interested in building massive wealth with real estate?

Then be sure to check out my real estate house hacking posts, which explain step by step how we’re creating real estate wealth by having others pay our mortgage on multi-million dollar real estate.

Hey Andrew – great post! Can you provide a follow up post that factors in the new rules in the recently passed tax plan?

Yep, it’s on my to do list. Hopefully sometime in January 2018!