In my inaugural income report post, I wrote that on the eve of my marriage, I wanted to “baseline” my net worth.

I wanted to take stock of my income, spending, savings, and investments because I wanted to understand how my net worth had trended since I entered the workforce after graduate school.

While I had kept decent historical records, I had never really crunched the numbers holistically, looking across the entire time series of the last several years. I felt doing this analysis would be a good baseline from which to understand my financial past, so I could figure out what I should change to grow my — and my newlywed’s — financial future.

In this post, I’ll deep-dive into my income and expenses over the last several years.

I’ll share key insights I learned along the way, and I’ll also give you the exact tools I created to do this analysis. Finally, I’ll offer some actionable advice to help you grow and diversify your income streams so you can build up your wealth more quickly with a multi-prong strategy.

What Were My Income and Expenses?

There were a few key questions I wanted to understand about my income and expense history.

- What was I spending each month relative to what I was earning?

- What did that mean in terms of how much financial freedom I was acquiring each year?

- How had major expenses like paying off my student loans impacted my net worth?

Here is what my income and expenses looked like since I graduated from school.

Want to know how I did this analysis?

I blurred out specific dollar amounts because the point of this blog is about hacking wealth, not focusing attention on my (or anyone’s) job salary levels.

While I am committed to sharing techniques and data transparently — since concepts become actionable when rooted in concrete data and examples — showing my job salary doesn’t serve a productive purpose.

My goal is to share with you ideas and techniques to hack your wealth, either through building multiple independent diversified income streams, or through repeatable tactics you can use to increase your salary.

Telling you my salary doesn’t help me show you either of these. 🙂

With that in mind, after doing this analysis, there were a few observations that stood out to me.

1. My “fully loaded” expenses have hovered around roughly half my earnings

This surprised me because I actually thought I was saving about two-thirds of my earnings.

I felt I had always spent frugally, so learning that I was only tucking away roughly half my earnings into savings and investments made me realize (1) that my net worth may not have been growing as rapidly as I expected, and (2) that I’d probably do well to scrutinize my expenses more closely to see if there was any fat to trim off the bone.

One point of encouragement was that the expenses shown in my chart are fully loaded: they include every last cash expense outflow, from my federal and state taxes down to the ice cream sandwich I bought yesterday.

So the gap between the green income line and the red expense line is the true free cash generated from my personal income statement: in other words, my net income margin is ~50%, which is decently strong, although my goal is to get that even higher (ideally mostly by growing my earnings rather than cutting my expenses).

Which leads me to my second observation…

2. I was building roughly one year of financial freedom for each year I worked

This was OK, but if my savings rate was even higher — ideally through higher earnings — then the financial cushion accrued for each year of “working for the man” would be multiplicative: that is, I’d be building more than one year of financial freedom for each year of working.

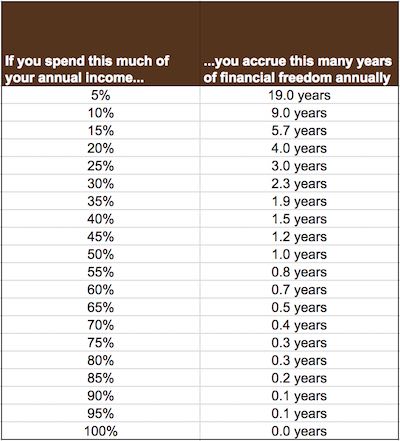

When visualized through a simple table and chart, this insight became glaringly obvious.

If you spend only 5% of your annual income each year, then you’re racking up 19 years of financial freedom annually.

Most of us cannot survive on only 5% of our annual income (indeed, taxes alone would be way more than that), but surely it’s possible to increase the savings rate beyond 50%.

At 50%, you’re getting “one for one” — one year of freedom in return for one year of bondage. If you could raise your savings rate by even 10% or 15%, you’d increase your financial freedom “velocity” by 1.5x – 2x.

At a 60% savings rate, you’d earn 1.5 years of freedom for every year of work, and at a 65% savings rate, you’d be clocking nearly 2 years of freedom for every year of work.

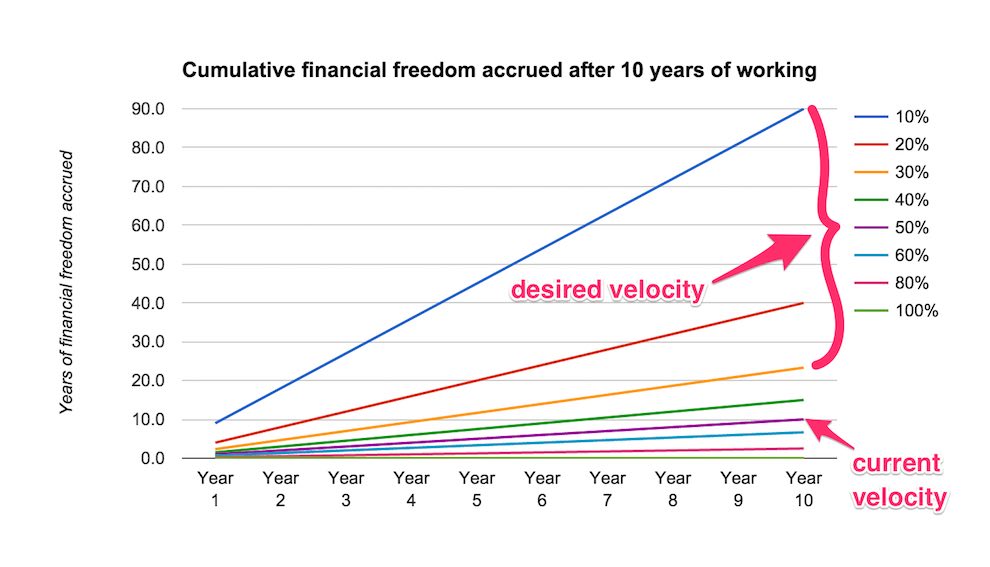

Visualized another way, it was clear that a higher savings rate wasn’t just a little bit better, it was multiples better.

As your savings rate increases, the slope doesn’t just elevate vertically, it also steepens because the outer years have accrued so much extra cushion.

At my current velocity of a roughly 50% savings rate, I was that pitiful purple line third from the bottom, just barely cobbling 10 years of cushion after a full decade of bondage.

To be able to reach financial independence sooner, I’d really have to crank up the savings rate — again, more easily achieved through increasing the income side of the equation — in order to experience the kind of multiplicative wealth-accumulation velocity that I wanted to.

I don’t think it would be realistic to hit the 90% blue line, but something around the 70% yellow line didn’t seem unfathomable.

To achieve this, I could cut down on more expenses. But I was actually already pretty frugal. I was skeptical this strategy would bear much fruit.

I don’t drive a fancy car, or wear fancy clothes, or eat at expensive restaurants. I don’t own pricey designer furniture or the latest tech gadgets. I don’t even own a TV, let alone cable TV service. And I haven’t recently traveled all that much, so cutting back on holidays wouldn’t yield too much savings (and would also disproportionately reduce life satisfaction given that I value experiences far more than material things).

I could, perhaps, eat out a little bit less frequently or be a little bit more efficient in my grocery shopping habits. I suppose I could also downgrade my apartment to a less convenient location.

But these didn’t really seem like game-changing tradeoffs, because the incremental savings wouldn’t be that much, yet the reduction in life satisfaction would be really high if I cut back on these things significantly.

That leads me to my third observation…

3. For me, hacking wealth would mostly have to be about increasing earnings, not cutting expenses

For most people, the fastest way to boost their wealth accumulation velocity is simply by cutting their expenses.

But given my spending patterns, I was already pretty efficient with my expenses.

So building wealth would have to come more from growing income than reducing costs.

Now, before starting my side businesses in 2012, my income was solely concentrated in my salary. And my salary was flat throughout most of the year, like a bond that pays a predictable premium. The only time it changed was when I got a raise or changed jobs.

But starting in 2012, my income began to look more like a stock: it fluctuated month-to-month, as sales moved up and down based on customer volume and my product development / marketing efforts.

I’ll get into details around my side business income in different post (here: Side Business Income), but the key point is that while the side income was just a trickle initially, it has slowly grown to more meaningful levels, and now it’s getting hard to ignore.

In the last 12 months, my salary itself was not the highest it’s ever been, but when combined with my other income streams, I cumulatively earned more the last 12 months than in any other year of my career.

This has taught me that, at least for me, the path to building wealth has more promise in diversifying my income streams and growing my side income.

My main goal now is really to grow my side business income into full-fledged primary income. My day job is important, and I like what I do, but my goal is to grow my alternate income streams to the point where I’m only working the day job because I want to, not because I have to.

That’s a very liberating feeling.

But that also brings me to my fourth point…

4. While my income grew, so too did my expenses

Even though my side business income was growing, my expenses also increased significantly after I became a homeowner.

I was now paying mortgage interest, after all, which is no different than renting an apartment — except the “apartment” you’re renting here is simply your mortgage loan.

Then there’s property taxes, which for expensive Silicon Valley homes can get real pricey real fast. And there’s all kinds of other goodies, like renovations, maintenance, insurance, and heftier utilities.

Luckily, those higher expenses were offset both by my side income as well as the rental income on the home, keeping my net income / savings margin hovering around 50%.

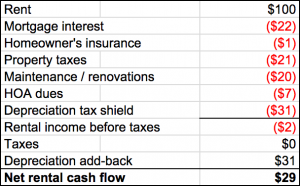

But I wanted to understand exactly how much I was netting from renting out the property. I did a quick analysis and discovered that, as of this post, for every $100 of rent I collected on the property, I essentially netted $29 in cash flow.

You’ll notice the “rental income before taxes” is actually negative!

That’s because, when you smooth it all out, the amortized expenses offset all the rental income, which means there are no taxes on that income because I’m technically running a loss.

But it’s still profitable! How?

Because of the depreciation tax shield. The IRS lets you depreciate the home value (but not the land value) of a rental property over 27.5 years and offset that depreciation against rental income.

It’s “funny money” because there is no cash flow involved. It’s just a shield against taxes by letting you reduce your taxable income on paper.

And that’s what’s going on here. Each month, I get to take $31 of depreciation for every $100 of rent. That lowers my taxable income by that much.

All the other expenses combined take my rental income negative, which means I pay no taxes at all.

After “passing go” and skipping the tax man, I still technically have the $31 of rental income cash in my hand. So that gets “added back” after it has served its tax shield purpose — again, because it’s a non-cash charge, and what I’m interested in as a homeowner is the cash flow of the rental property.

So what I have in my pocket at the end of the day is $29 per month: which is the original $31 “shielded” cash, minus a couple extra bucks for excess expenses.

But it gets better. Over time, that $29 per month will steadily increase, because my mortgage interest will continue to shrink as a proportion of total costs.

By the way, I only count mortgage interest and not mortgage principal in this analysis, because mortgage principal simply gets added to my home equity. I still own it at the end of the day. So it’s not actually an expense. It’s just converting it from one format (dollars in my wallet) to another (dollars in my home equity).

Whereas mortgage interest is a true expense that’s the rental price of borrowing money in the first place. (As in, I’ll never see those dollars again.)

To be sure, I love my Palo Alto home, so renting it out was like giving away my newborn child. But a new job took me up to San Francisco, and renting out my Paly home was the only realistically affordable option.

For now, it’s monetizing decently well. Someday, I’ll move back there. Until then, the home will remain productively occupied and I’ll collect annually escalating rents while paying down an annually stable mortgage (and shrinking interest expense).

There were other major expenses during this time as well:

- I paid off all my law school debt in a single bullet payment at the start of 2011

- I bought my car off its lease in the summer of 2011

- I did major house renovations in the fall of 2012, and again in summer 2013

- I custom-made an engagement ring in the fall of 2013 to propose to my fiancee (now wife)

- And I got married just after launching this blog, in the fall of 2015

These were major life expenses, and I budgeted for all of them, but they definitely took some wind out of my wealth-building sails.

In particular, paying off all my law school debt in one fell swoop was momentous; I did it because I anticipated starting my own company later that year, and I didn’t want this huge debt burden noosed around my neck while I tried to make ends meet starting a company. (Student loans are the one debt obligation you cannot discharge in bankruptcy, so it behooves you to pay it off as quickly as it makes sense to.)

But it definitely decelerated my wealth building velocity, and I’ll talk about those details in the net worth post of this series. For now, it’s enough to know that the law school “payoff month” was easily the most expensive month I’ve ever had in my life, eclipsing the next most pricey month by more than 2x.

Takeaways and advice

Spending time to do this analysis was immensely insight for me, because I had never analyzed my income and expense history or my net wealth velocity over such a long period.

I highly recommend you to do the same analysis. In fact, I found the exercise so useful that I want to share with you the exact spreadsheet template I created to parse the data and visualize my analysis with charts:

The insights I gleaned from the analysis also motivated me to double down on figuring out how to grow my side business income into full-blown primary income, so that I could control my wealth-building destiny more closely.

I believe the key to building wealth is in creating diversified income streams such that if any one of them vanishes overnight, you don’t get totally hosed.

At the same time — and this is somewhat paradoxical — it’s important to guard (and grow) every income stream ferociously, as if it’s your one and only. Treat it like your life depends on it and you have no other income sources. Then totally forget about it when you move on to the next stream. That will keep you hungry and focused and disciplined in trying to maximize each stream.

If there is one takeaway I want to leave you with for hacking your wealth, it’s to create diversified income streams beyond your day job salary.

It takes a long time to build these up, but after you do, you develop a lot more confidence in your capabilities and career moves, because no one bad move will take you down. It also helps you put your job into perspective, because your identity isn’t wrapped up in just one job; it’s spread out over several revenue-generating initiatives.

In a future post, I’ll share tips on how to come up with side business ideas that leverage your unique skills and interests and help you start generating side income.

Until then, be sure to check out the other posts in this series:

- Income and Expenses – you’re reading this post!

- Side Business Income

- Net Worth

[…] Photo: Hack Your Wealth […]