Ah, spring. Warmer weather, longer days. And…tax season. Yuck. Even though paying the taxman is never fun, here’s a tip to make it a little less annoying.

Since the tax filing deadline is almost here (April 18 in most states) and some people have asked, I’ll show you today how to earn some quick money from paying your taxes.

You’ll need:

- A federal or state tax liability (if you’re owed a refund for both federal and state, this won’t work for you)

- Ability to pay online (like, a computer)

- Up to 2 new credit cards whose point sign up bonuses you want (…my favorites are the Chase Sapphire Preferred, Chase Ink, and Amex SPG)

Here’s how to do it:

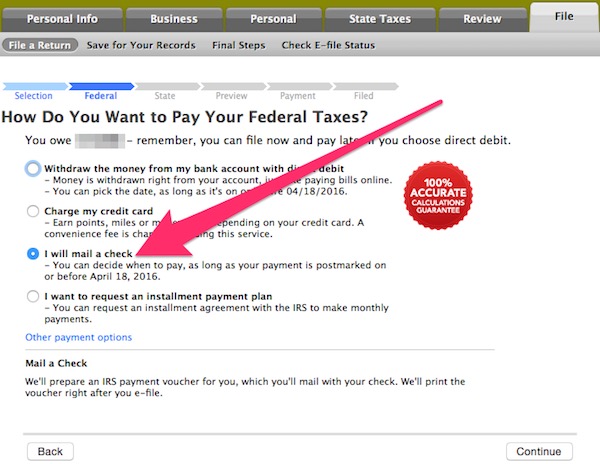

Step 1: Don’t include your payment when you file

In your tax filing software, just before you submit, make sure you select the “pay by check” option.

Here’s a screenshot from TurboTax showing you what it looks like:

Don’t pay your tax liability directly in your tax software; that’ll be more expensive, around 2.5%. Instead, choose the pay by check option and e-file first. TurboTax will e-file your federal return for free and charge you $25 for e-filing each state. (Pay the $25 with your credit card, but not any liability.)

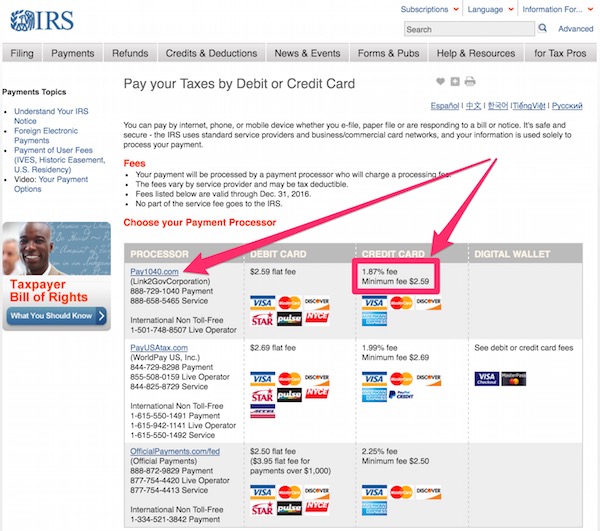

Step 2: Go to Link2GovCorporation

The IRS accepts online payments from 3 different vendors: Link2GovCorporation, WorldPay US, and Official Payments.

You can see on the IRS website a description / comparison of the 3 vendors the IRS accepts online payments from.

For credit card payments, you’ll see that Link2GovCorporation is the least expensive option charging a 1.87% fee.

Click the link to go to the Link2GovCorporation website.

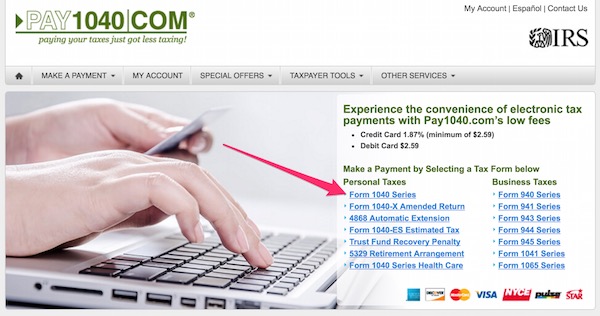

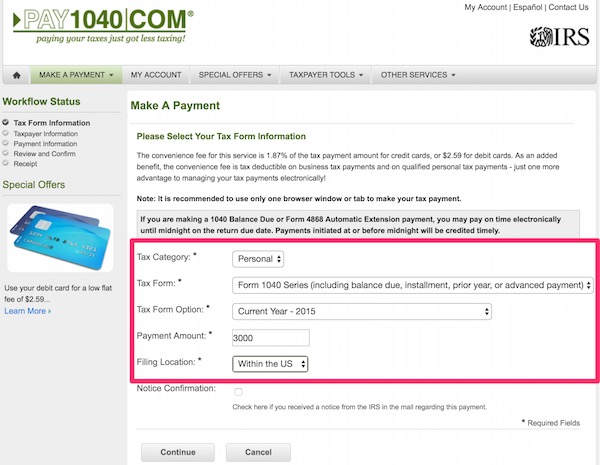

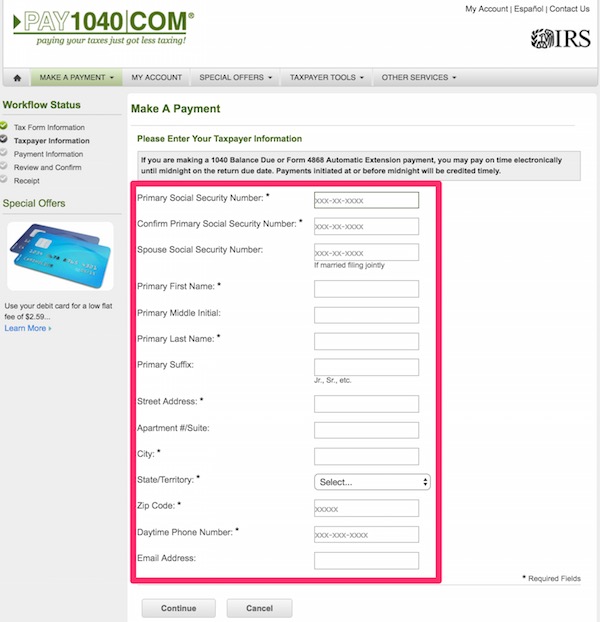

Step 3: Select the correct option and fill out the form to pay your tax liability

Click the appropriate option to start the payment checkout flow:

You’ll fill out a 2-page form that collects identification info such as your and your spouses’s names, social security numbers, mailing address, and phone numbers. You’ll also specify what you want to pay for: a regular 1040 payment, a business tax liability, an amended 1040, etc.

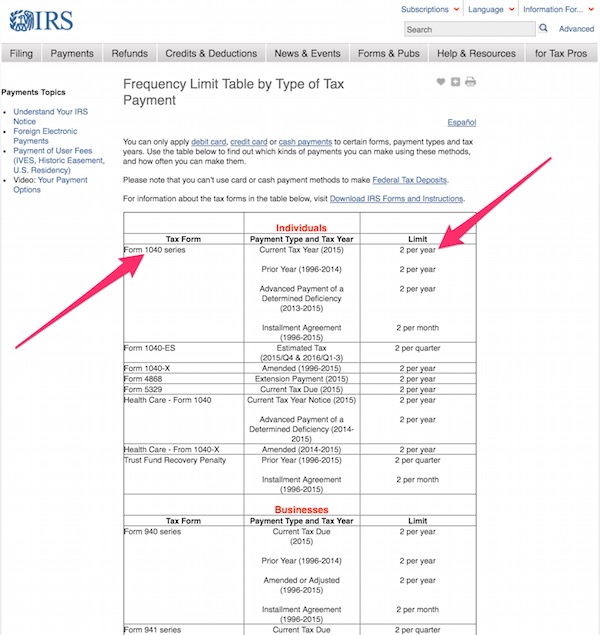

You are limited to using 2 credit cards per tax liability

Note that you’re only allowed to split a single tax filing’s liability across 2 payments…

…which means you’re limited to collecting 2 credit card point sign up bonuses. (see IRS website stating this)

If your tax liability exceeds the minimum spend requirement for both cards combined, sorry you’re outta luck. You can’t use a 3rd card, so you’ll have to “overcharge” one of the cards.

Now, normally I’d say paying your taxes by credit card is not worth it if it’s only for the regular point value. It’ll cost you 1.87% in processing fees but points are often worth less than 1.87 cents per point, assuming you get 1 point per dollar spent (sometimes you can rack up multiple points per dollar depending on the card and purchase, but usually that won’t be the case for a tax bill).

However, if you can get 2 credit card sign up bonuses, then it can be a significant windfall. I did it with the Amex business SPG (35,000 point special bonus) and Amex Business Gold Rewards cards (80,000 Amex point bonus).

The SPG points alone are worth 13 nights(!) at an entry-level (Category 1) Starwood hotel property.

The Amex points are more variable. If you shop on Amex’s online portal, the redemption values are terrible, around half a penny per point. If you transfer out to partner airlines, the values range from a penny per point all the way up to 7+ cents per point, depending on what flight you buy with those points.

Even if you assume the points are only worth 1 cent each, when combined with the SPG points, I figure the total value of both sign up bonuses is worth around a couple thousands bucks combined. It’s like I paid a few hundred in credit card fees, and got a couple thousand in return.

If that was a stock investment…I’d do that ALL DAY.

Don’t e-file with the IRS-approved vendors; just pay your tax and e-file with TurboTax

Note these IRS-approved payment vendors also offer e-filing of your taxes in conjunction with your online payment. Skip the e-file. They’ll charge you 2.5% combined for both services, but it’s cheaper to e-file with TurboTax because your federal returns are free and your state return is $25. (I don’t think you can even e-file your state return with the IRS-approved payment vendors.)

By e-filing and paying separately, your fees drop to 1.87%.

Filing and paying your state taxes

If you owe a state tax liability, you’ll follow a similar process as described above for your federal taxes. I can’t walk through the filing process for all 50 states, but consult your state’s internal revenue department or tax board for more info.

You can find your state’s tax website using one of the links below:

- http://www.taxadmin.org/state-tax-agencies

- https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/State-Links-1

And…now you know how to make some quick extra money from paying your taxes. Have fun racking up those points!

Be sure to also check out our related post on the new tax reform bill: How the final Trump tax bill affects you.

Click below to file your taxes with TurboTax and get your maximum guaranteed refund:

Leave a Reply