If you’ve ever wondered how to shield more income from taxes using turbo-charged retirement account contributions, one very powerful technique is to open a Solo 401k.

A Solo 401k is the same as a traditional 401k, except that it is meant for a sole proprietor business owner and, optionally, a spouse.

In this post, I’ll show you:

- How a Solo 401k works

- Why it’s superior to its sibling alternatives: SEP, SIMPLE, and IRA

- Basic strategy for maximizing its impact

- And finally, the Solo 401k application process step by step

I have self-employed / side income and want to avoid taxes. What are my options?

If you want to shield your solo earnings from taxes by using a retirement account, you basically have four options:

- Simplified Employee Pension (SEP IRA)

- Savings Incentive Match Plan for Employees (SIMPLE IRA)

- IRA or Roth IRA

- Solo 401k

The main difference among these options is the max you can contribute each year.

SEP IRA

Contribution limits

With a SEP IRA, you can contribute:

- 20% of your net self-employment earnings as a sole proprietor

- Or $66,000

…whichever is less.

SEPs are funded by employer contributions only. No individual contributions (called “elective deferrals”) are taken out of your paycheck. Since there are no elective deferrals, there are also no catch up contributions. Those only apply to elective deferrals.

Net self-employment earnings

Let’s take a closer look at the “20% of net self-employment earnings.” Net self-employment earnings is defined as:

- Total business income

- LESS: business expenses

- LESS: half your self-employment taxes

Since self-employment (FICA) taxes are 15.3%, half that is 7.65%. So net self-employment earnings = your profits times 92.35%. You can contribute up to 20% of that, max $66,000.

Now, if you’re paying close attention to the IRS rules, you’ll see they actually say 25% of employee compensation. How does that square 20% of net self-employment earnings?

The 25% applies to your W-2 salary if you are an employee of someone else’s company, whereas the 20% applies to your net self-employment earnings if you are a sole proprietor.

Example:

As an employee, you earn $40,000. Your employer contributes 25% of your salary into your SEP, or $10,000. So your total income is $50,000, 20% of which is a SEP contribution from your employer.

By contrast, as a sole proprietor, you can contribute the same 25%…but only from the actual SALARY portion of your total compensation. So you cannot include the SEP contribution itself when computing that 25% ratio, because that would be recursive. That’s why for self-employed people it equates to 20% of net self-employment EARNINGS, not 25% of SALARY: because whereas $1 salary for a plain vanilla employee is supplemented by 25 cents employer SEP contribution, $1.25 profits when you’re self-employed means you can only take out 20% (25 cents) to fund your SEP.

And remember, you also have to subtract self-employment taxes first. So let’s do that.

Continuing the example above, say your profits are $50,000, i.e., after subtracting expenses from income. Take out half self-employment taxes (7.65%): multiply profits by 92.35% = $46,175. Now take 20% of that as your employer SEP contribution = $9,235.

Other SEP rules

Since a SEP is just a type of IRA, you can invest in the same stuff you could with a traditional IRA: stocks, ETFs, fixed income, mutual funds, etc. Similar restrictions also apply: you generally can’t withdraw without a penalty before 59.5; when you do it’s considered ordinary income.

Deadlines

The deadlines for both establishing a SEP IRA plan AND making contributions to it is the tax filing deadline (usually April 15 of the next year, October 15 for extended filers).

More questions? Check out SEP IRA Plan FAQs.

SIMPLE IRA

Contribution limits

A SIMPLE IRA is similar to a regular IRA, except the max contribution is:

- Up to $15,500 individual contribution (plus $3,500 catch-up for 50 or older)

- Plus an employer match up to 3% of employee compensation (or net self-employment earnings as a sole proprietor)

Remember, net self-employment earnings = profits – half of self-employment taxes = profits times 92.35%.

Example:

As a 35-year old, your net self-employment earnings is $50,000. Assuming you only contribute to a SIMPLE plan, the max you can contribute for the year is $17,000 ($15,500 individual contribution + 3% of $50,000).

Other SIMPLE rules

The same rules apply to SIMPLE plans as other IRAs in terms of investments, distribution and rollover rules. However, one key difference between a SIMPLE vs. SEP is that the penalty for withdrawing within 2 years of plan inception is higher for SIMPLE plans. You’ll be penalized 25% of withdrawal vs. only 10% for a SEP.

Deadlines

The deadline for establishing a SIMPLE IRA is October 1 of the current year. The effective date of the plan cannot be before the plan is actually established. You must make your individual contributions by December 31. The employer match must be made by the tax filing deadline, usually April 15 (October 15 for extended filers).

More questions? Check out SIMPLE IRA Plan FAQs.

IRA and Roth IRA

Contribution limits

The max contribution for a plain vanilla IRA or Roth IRA is:

- $6,500 ($7,500 if you’re 50 or older)

IRA contributions are tax-deductible; Roth IRA contributions are not.

Roth IRAs are subject to income limits, which means as your income increases, the max contribution decreases, and eventually goes to zero:

| If your filing status is... | And your modified AGI is... | Then you can contribute to a Roth IRA... |

|---|---|---|

| married filing jointly or qualifying widow(er) | < $218,000 | $6,500 per spouse |

| > $218,000 but < $228,000 | a reduced amount | |

| > $228,000 | zero | |

| married filing separately and you lived with your spouse at any time during the year | < $10,000 | a reduced amount |

| > $10,000 | zero | |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year | < $138,000 | $6,500 |

| > $138,000 but < $153,000 | a reduced amount | |

| > $153,000 | zero |

Traditional IRAs are also subject to income limits in some cases, so as your income increases, the tax deductibility of your IRA contribution may decrease and eventually goes to zero.

Assuming you or your spouse are already covered by another retirement plan at work (which includes a SEP, SIMPLE, or Solo 401k), then the income limits for IRA tax deductibility are:

| If your filing status is... | And your modified AGI is... | Then for your IRA you can take... |

|---|---|---|

| married filing jointly or qualifying widow(er) | < $116,000 | full deduction up to contribution limit |

| > $116,000 but < $136,000 | partial deduction | |

| > $136,000 | no deduction | |

| married filing separately and you lived with your spouse at any time during the year | < $10,000 | partial deduction |

| > $10,000 | no deduction | |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year | < $73,000 | full deduction up to contribution limit |

| > $73,000 but < $83,000 | partial deduction | |

| > $83,000 | no deduction |

On the other hand, if you are NOT covered by an existing retirement plan, then the income limits governing your IRA tax deductibility are:

| If your filing status is... | And your modified AGI is... | Then for your IRA you can take... |

|---|---|---|

| single, head of household, qualifying widow(er), or married filing separately and you did NOT live with your spouse at any time during the year | No limit | full deduction up to contribution limit |

| married filing jointly or separately + spouse is NOT covered by a plan at work | No limit | full deduction up to contribution limit |

| married filing jointly + spouse IS covered by a plan at work | < $218,000 | full deduction up to contribution limit |

| > $218,000 but < $228,000 | partial deduction | |

| > $228,000 | no deduction |

Non-deductible contribution option

If you exceed the income limit, you can always make a non-deductible contribution to your traditional IRA. But doing that means you will pay ordinary tax rates on all your investment gain (your original basis won’t get taxed again). Whereas if you put this money into a regular taxable account, your investment gain would be taxed at lower capital gains rates; plus, there would be no restrictions against withdrawing before 59.5.

So, why the heck would anyone make a non-deductible IRA contribution?

Simple: Roth Conversion. You can take IRA dollars and convert them to Roth, pay taxes at conversion, then all subsequent growth and withdrawals are tax-free. Tax-free, baby!

Roth conversions also have no income limits and no conversion limits, so you can earn infinity and convert infinity to Roth. You’ll just pay taxes once at the point of conversion and never again. If you do it right, you can even pay zero taxes at the point of conversion using a Roth ladder.

Other IRA / Roth rules

Both IRAs and Roth IRAs let you start withdrawing penalty-free at 59.5, but traditional IRAs REQUIRE to you start withdrawing by 73. No such requirement for Roths. When traditional IRA money is withdrawn, anything that hasn’t yet been taxed gets taxed at ordinary rates — again, unless you use a Roth ladder. When Roth money is withdrawn, it’s always tax-free.

You can always withdraw original Roth contributions penalty-free and tax-free; you simply can’t withdraw GAINS until 59.5. There are also times when you can withdraw from your IRA early (before 59.5) penalty-free. Here’s a useful IRS chart showing all the exceptions for early distributions.

Deadlines

The deadline for both establishing AND contributing to an IRA or Roth IRA is the tax filing deadline, usually April 15 of the next year. Applications and contributions must be postmarked by this date to qualify, and there are no extensions even for late filers.

More questions? Check out IRA Plan FAQs.

Solo 401k

Contribution limits

A Solo 401k is just like a regular employer 401k but designed for a sole proprietor with no employees, or sole proprietor plus a spouse. With a Solo 401k, you make contributions as both employer AND employee. Depending on your brokerage firm, you may have access to a Roth option for your Solo 401k.

Either way, your max contribution is:

- $22,500 individual contribution ($7,500 catch up if 50 or over)

- Plus non-elective employer contributions of 20% of net self-employment earnings

Total contributions to per person, excluding catch-ups for those 50 or over, cannot exceed $66,000. That’s a hard cap.

For the individual contribution, the $22,500 limit is imposed on each person, not on each plan. So if you’re participating in a traditional employer 401k while ALSO contributing to a Solo 401k via your side business, the IRS doesn’t let you contribute $22,500 to each one. You get $22,500 for you as a PERSON, and that’s it.

For the non-elective employer contribution, the definitions here are the same as the SEP IRA case above. The 20% applies to net self-employment earnings, which equals income less expenses less half self-employment taxes: or profits times 92.35%.

Note that if your Solo 401k has a Roth option, you may only contribute your individual $22,500 portion to the Roth. The employer portion must be made as a traditional, pre-tax (i.e., non-Roth) contribution.

Example:

As a self-employed business owner, you earned $400,000 total income last year and spent $77,500 in costs. You paid your spouse exactly $22,500 salary to help with bookkeeping. You both don’t contribute to other employer 401ks. You max out your individual Solo 401k contributions. The company maxes out the employer contribution.

$400,000 – $77,500 – $22,500 = pre-tax profits of $300,000. The max employer contribution is 20% “net self-employment earnings.” So: $300,000 times 92.35% = $277,050. 20% of that is $55,410. That’s the max employer contribution per person.

So you and your spouse each have $77,910 in total deferrals ($22,500 + $55,410). However, the hard cap is $66,000 per person, so you’ll be limited to that. (If you were 50 or older, you could do the $7,500 catch-up on top of that.) Since we assume you’re under 50, you’ll each max out at $66,000, or $132,000 total. That’s the max that gets shielded from taxes.

Part-time employees

If you have part-time employees, you can exclude them from your Solo 401k if they worked fewer than 1,000 hours during the year. Once employees exceed this threshold, the Solo 401k won’t work anymore and you’ll have to upgrade to a traditional 401k.

Deadlines

The deadline for establishing a Solo 401k is the end of the business tax year in which you want to claim a tax deduction for contributions, usually December 31. (By contrast, a SEP can be established up until the tax filing deadline.)

You must specify your elective individual contribution by December 31, but the contribution itself doesn’t have to be deposited until the personal tax filing deadline of April 15 (October 15 for late filers). The deadline for funding the employer contribution is also April 15 / October 15.

No discrimination testing required

While traditional 401k plans must undergo annual “discrimination” testing, Solo 401k plans don’t have to. What’s this about?

There’s something called the Employee Retirement Income Security Act, or ERISA. ERISA requires several tests each year to prove traditional 401k plans do not discriminate in favor of high-income employees. Congress didn’t want the tax breaks of 401ks to accrue disproportionately to high-income folks.

So ERISA tests 401k plans annually to show that plan benefits:

- Are broadly accessible to most / all employees (coverage test)

- Do not result in contributions lopsided toward high-earners (discrimination test)

- And do not result in total accumulated benefits that are too top-heavy toward high-earners (top-heavy test)

The purpose is to ensure everyone is benefitting from the 401k plan. So, if high-earners are pouring money in, then non-high earners have to do the same. The employer must incentivize non-high earners to do this, and the most common incentive used is the employer match.

Solo 401k plans, however, only have ONE participant or, at most, an additional spouse. So it isn’t really possible to discriminate in the way Congress meant to avoid. That’s why a sole proprietor with no employees can avoid annual nondiscrimination testing under a Solo 401k. This reduces administrative burden and cost.

>$250,000 in plan assets

Once your Solo 401k plan exceeds $250,000 in plan assets, you have to file Form 5500 annually with the IRS. You can either complete Form 5500-EZ and snail mail it, or fill out Form 5500-SF online and submit it electronically.

Why a Solo 401k is the best

A Solo 401k is superior because it usually allows you to shield the most money possible from taxes. This is especially true given that you can “double dip” by employing your spouse, which means you can sometimes save double the amount you could (or more) vs. the other accounts.

When combined with powerful strategies to ladder out to a Roth IRA down the road, the Solo 401k is the best retirement account option for self-employed folks.

Strategy for maximizing a Solo 401k

The basic strategy for shielding maximum income from taxes using a Solo 401k is to double up with your spouse.

Here are the steps:

- Pay your spouse up to $22,500 salary (give your spouse something meaningful to do so your payments are legit). Ideally, the salary should equal the max individual contribution.

- Maximize your individual contributions to the Solo 401k. Assuming you don’t contribute to another employer 401k, you can contribute max $22,500 for the year.

- Pay out the max employer contribution of 20% net self-employment earnings. That’s 20% of profits times 92.35%.

- OPTIONAL: While not part of the Solo 401k, if you have an HSA account associated with your health insurance you can tuck away even more pre-tax money into it: $3,850 max for the year if you’re single, $7,750 for families, and $1,000 catch-up if you’re 55 or older.

In concrete terms, if you max out your Solo 401k between you and your spouse, here’s how much you can earn with zero tax liability.

This assumes:

- You are married filing jointly with no kids

- You are taking the standard deduction

- You and your spouse do not contribute to other employer 401k plans

Here’s exactly how the math breaks down:

Initial profit: $113,097.36 (AFTER all business expenses)

Less: $22,500 (salary to spouse, who will self-contribute to their Solo 401k)

Equals: $90,597.36 (profit)

Less: $6,930.70 (7.65% of profit = half self-employment taxes)

Equals: $83,666.66 (compensation before employer contribution)

Less: $33,466.66 (employer contribution: 20% net SE earnings for both spouses, total 40%)

Less: $22,500 (self-contribution to Solo 401k)

Equals: $27,700 (net compensation, after all Solo 401k contributions)

Less: $27,700 (MFJ standard deduction)

Equals: $0 taxable income baby!

This is with the standard deduction.

If you have significant itemized deductions, it’s possible for gross profits to exceed 6-figures and still avoid taxes (other than the half of self-employment taxes). $113,097.36 is just the minimum.

And the best part? You can ladder out all the money you shield from taxes to Roth later. Simply roll your Solo 401k into a regular IRA first, then convert to Roth.

So, what does this translate to in terms of REAL numbers?

If you max out contributions upfront and capture the tax savings now, it can translate to a LOT of savings depending on your marginal tax bracket.

If your marginal tax rate is 25%, then every dollar you put into your Solo 401k shields 25 cents in taxes. That’s 25 cents more PROFIT….for doing something that’s good for you anyway, i.e., saving for your own retirement.

Another perspective: If every dollar of your revenue requires 50 cents of expenses, then your profit margin is 50%. So, saving 25 cents in taxes for every dollar put into your Solo 401k is equivalent to getting 50 cents additional topline revenue.

Assuming you’re in the 25% tax bracket, the individual $22,500 contribution is like getting a $5,625 government match, and if your profit margins are 50% it’s like $11,250 extra topline revenue. When you add the employer contribution (max $66k for both elective and non-elective combined), the benefits are even greater.

That’s per person. Add a spouse and everything doubles. Glee!

OK, so how do I actually set up a Solo 401k? Step-by-step walkthrough

Here are the steps involved setting up a Solo 401k.

1. Decide which brokerage you want to set up your Solo 401k with

Basically, you should have screening filters to decide where you want to open your Solo 401k. Here are my personal screening criteria:

- Zero set up fees

- Zero account maintenance fees (or if not zero, then it’s very easy to get an exemption from the fees, either because you have another personal account with the brokerage, or you easily meet a minimum balance requirement, or you opt into electronic communications, etc)

- Zero required deposit minimum

- Accepts incoming rollovers for free from any account type: SEP, other 401ks, other IRAs

- Can roll out to other 401ks or IRAs for a reasonable fee

- Has a Roth 401k option and supports in-house Roth conversion (I don’t plan on using this near-term, but still good to have if and when I need it)

- Can invest in any stock, ETF, bond, option, or security that I’d otherwise be able to using a regular investment account with that brokerage

- Brokerage has a wide selection of investments to choose from: stocks, ETFs, mutual funds, etc

- Trading commissions and fees are similar to (or even less than) those for my regular brokerage account. Also, are there any commission-free securities?

- Bonus if I already have an account with that brokerage; it just makes things easier

You can usually find some of this basic info directly on each brokerage’s Solo 401k webpage.

For example, Fidelity’s Solo 401k product shows no set up or maintenance fees, and you can use your Solo 401k to invest in most mutual funds, stocks, bonds, ETFs, and other securities available to regular Fidelity account holders.

Vanguard’s Solo 401k has no set up fee but does have a $20 annual fee charged for each Vanguard fund held in the account; that fee is waived if you have $50,000 invested in Vanguard funds or ETFs.

Etrade’s Solo 401k has no set up or maintenance fees and states you can roll over assets from other SEP or SIMPLE IRAs into the account.

Also, the major brokerages such as these generally do not have required deposit minimums.

I decided to go with TD Ameritrade’s Solo 401k a long time ago (now owned by Schwab) because the terms and fees were similar and competitive with other brokerages, and I already had other accounts with TD, so was familiar with their online systems already. Note they’ve since retired their Roth Solo 401k option and the administration of the program is moving over to Schwab.

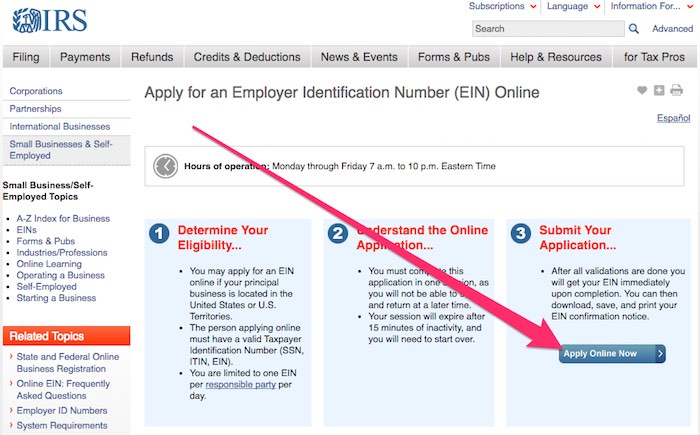

2. Apply for an EIN with the IRS

To apply for a Solo 401k, you cannot just use your social security number, which you might have been using for other business purposes up until now (since that’s usually all you need as a sole proprietor).

You have to get an Electronic Identification Number, or EIN, from the IRS. This is basically a number that identifies your small business, just like your social security number identifies you. You’ll need your business EIN before you fill out your Solo 401k application.

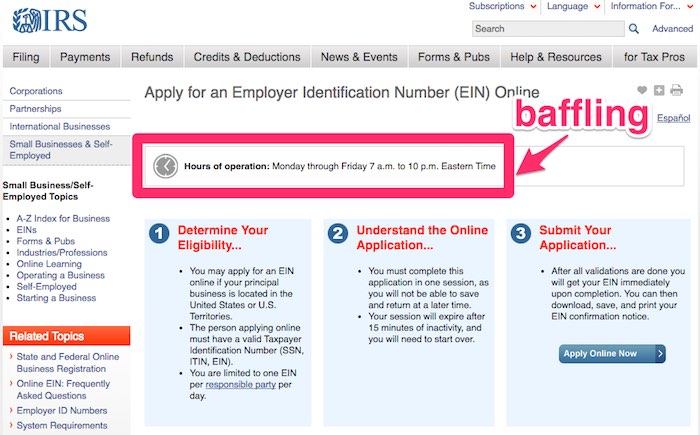

You can apply for an EIN in various ways: online, mail, phone, or fax.

To apply online, click here. Then click the apply button.

Baffling, but apparently this online system only operates Monday – Friday, 7 am to 10 pm Eastern. I guess the robots need nights and weekends off, too.

When you fill out the EIN application, be ready to provide the following info about your business:

- Legal name – this can be a unique name or just your own personal name. It will encompass all business endeavors that you operate as a sole proprietor.

- Start date of the business – month and year.

- Address of the business – this will be linked to your EIN, so best use a stable address that won’t need updating often. Can be home or office address or PO Box.

You’ll need to remember these details come tax filing time, because they’re used when reporting your sole proprietor taxes.

If you’re a sole proprietor and requested an EIN for a business in the past using your social security number, you may get an error when trying to apply for another EIN online. If that happens, just call the IRS automated phone system to get an immediate EIN at 800-829-4933.

More questions? Check out EIN FAQs.

3. Fill out the key forms

As far as I know, you cannot apply for a Solo 401k online anywhere. (This is true both at TD Ameritrade and other major brokerages.) You must download a PDF application, print it out, fill it out, and mail it back. UPDATE: Readers have reported that Vanguard allows you to open a Solo 401k completely online.

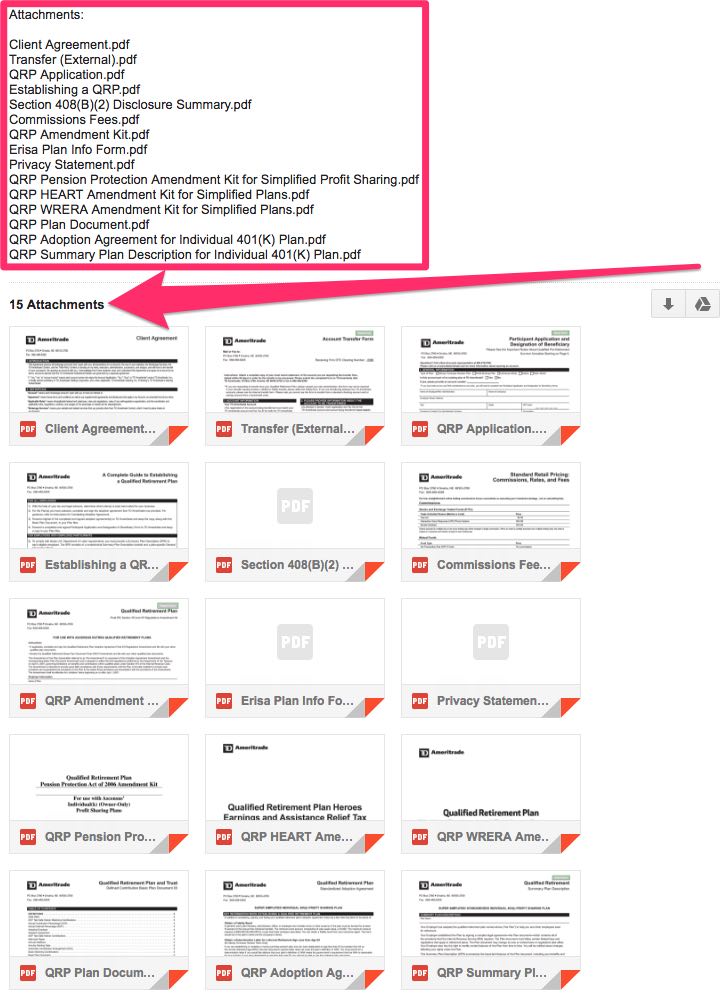

Your brokerage will probably send you a FLOOD of documents when you request the Solo 401k paper application. TD Ameritrade sent me FIFTEEN different PDFs in a single email.

Luckily, only two matter:

- Solo 401k Adoption Agreement

- Solo 401k Application form

That’s all you need to open the Solo 401k. If you plan to roll in any previous IRA or 401k money into the Solo 401k, you’ll also need a third transfer form. But that’s it.

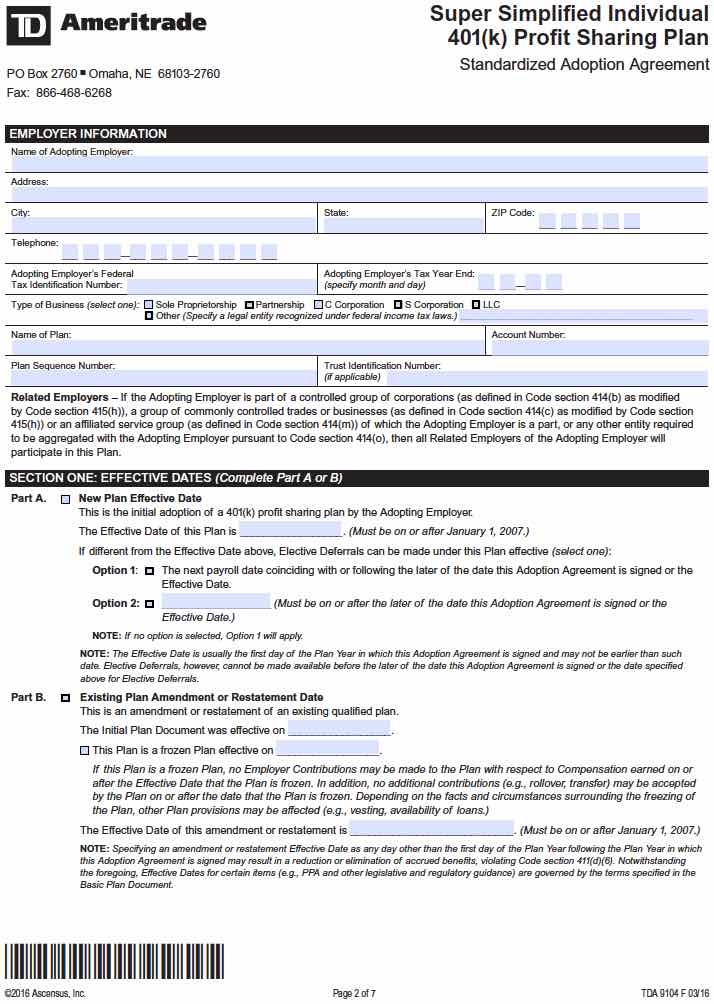

The purpose of the Solo 401k Adoption Agreement is to say, “Hey TD Ameritrade, I’m a self-employed business owner and, by filling out this adoption agreement, I’d like to open a Solo 401k account with your brokerage.”

In this document, you’ll fill out the following info:

- Company’s name and address

- EIN

- Legal structure (sole proprietor, LLC, S-Corp, etc)

- Plan name (if you’re establishing a new plan, something like “Andrew Chen Individual 401k” is sufficient)

- Effective date of the plan (I put January 1 of the application year)

- Eligibility requirements for participating in the plan (age and length of service requirements)

- What type of elective deferrals will be permitted (traditional, Roth, or both)

- Whether loans may be taken out against plan assets

You can ignore the stuff about Trust IDs and Trustee info because Solo 401ks are exempt from the trust requirements of ERISA. (ERISA only applies when you have employees other than yourself or your spouse.)

Your “custodian” will already be pre-filled (and uneditable) as the name of the person who is the Managing Director of Investor Services at TD Ameritrade.

You’ll also see 2 pages at the end which you can ignore if you’re establishing a new plan:

- Protected Benefits and Prior Plan Document Provisions Attachment

- Other Plan Information Attachment

TD Ameritrade is required to provide you these so you can specify additional provisions applicable to your plan. But these would only be relevant if such provisions existed in the first place, which only happens if, say, you are amending or restating an existing qualified plan, or there are trust documents with additional governing plan provisions. If you are establishing a new Solo 401k, neither should apply and you can ignore these pages.

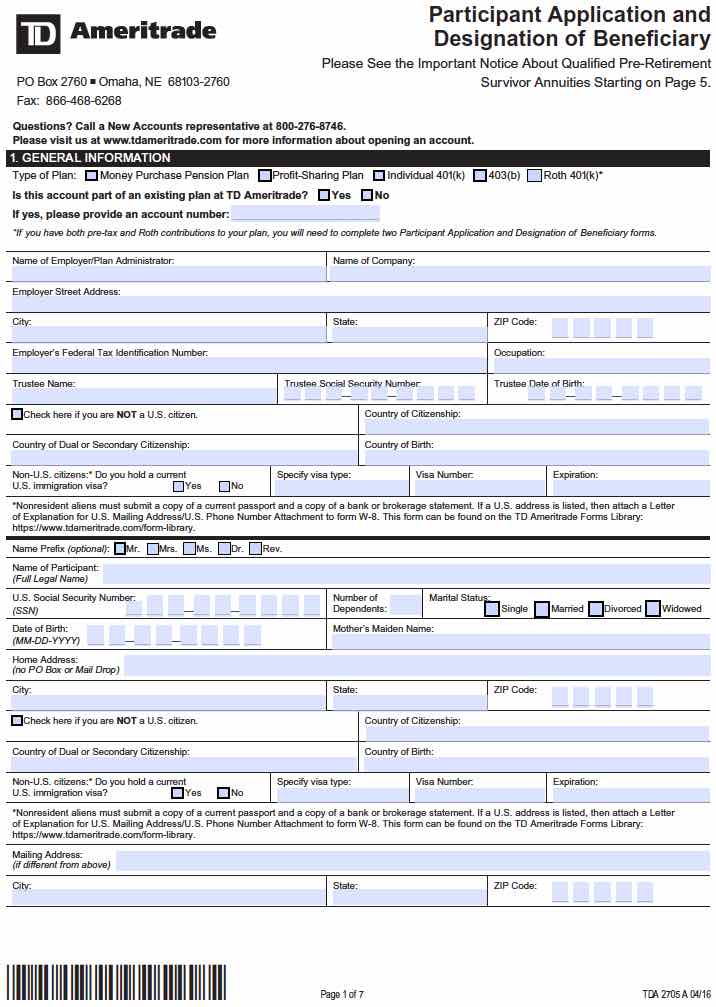

The purpose of the Solo 401k Application form is to say, “Hey TD Ameritrade, you know who’s gonna be BOTH the administrator AND the participating employee in this Solo 401k? Wait for it……ME!”

That’s right, this form has two functions. One, it designates who will control the plan features and have the power to make changes and see account info of plan participants. Two, it states who is actually going to participate in the plan. If you are a one-person shop (or running a business with only your spouse), then you will be both administrator (employer) and participant (employee).

On this application form, you’ll fill out:

- What kind of plan you are establishing (traditional, Roth, Profit-Sharing)

- Administrator info (name, address, EIN, citizenship)

- Participant info (name, address, social, citizenship)

- Investment objectives (conservative, moderate, growth, aggressive)

- Cash sweep choice (what should TD do with any cash in your account)

- Beneficiary selection (who will get your money if you die)

- Spousal waivers if you didn’t choose your spouse as the beneficiary

Once again, you can ignore the stuff about Trustees, Fiduciaries, and ERISA because Solo 401ks are not regulated by ERISA.

4. Submit your application and wait ~10 days for approval, then fund your account

After you complete the above forms, mail them back to the address listed on the forms.

About 10 days later, you’ll get some welcome emails from TD Ameritrade saying they’ve received your application and established your new Solo 401k account. You’ll also get some paper documents in the mail with additional info about your Solo 401k.

When you create your online account, you’ll get instructions on how to link your bank account (or rollover an existing account) to fund your Solo 401k; there will be one webpage where you go to set up your administrative account (as employer), and another separate webpage where you login to set up your participant account (as employee).

If you are rolling over funds from other IRA or 401k accounts into your new Solo 401k, you’ll fill out a transfer form and submit it; it’ll take 3-4 business days to complete the rollover.

Final thoughts

Solo retirement account choices may seem overwhelming and the process for opening an account may seem cumbersome, but hopefully this post has shown you the best solo retirement option is usually a Solo 401k because it allows you to shield the most money from taxes.

And while the Solo 401k application process may seem tedious and complicated, it’s actually pretty straightforward. For TD Ameritrade, it’s just two forms. Most of the paperwork doesn’t apply to single-person business owners.

Be sure to also check out my podcast episode on everything you need to know about 401Ks.

Question: Have you opened a Solo 401k or other type of solo retirement plan? If so, what brokerage did you use and why? Any tips or strategies you learned in the process that you wish you’d known upfront?

Leave a comment — I’d love to hear your thoughts!

Do solo401k’s require an ERISA even though it does not pretain to us?

The ERISA question is addressed in the post. 🙂

Hi Andrew,

Incredible article ! I will be 63 this year . This year I am also self employed and live in California. I didnt even realize that you can have a ‘solo’ 401K. Is 20% the maximum amount you can put into the account? About 50% of my earnings will be taxed and this solo account will be invaluable to me. And say at 67 I begin to draw off of this acct plan it it taxable?

I look forward to your response. So many decisions to make.

PS. I also havent made a fee schedule too the IRS . My concern here is if I go by my earnings and taxes and telling you it will be about 50% then I wont have that 20% to deposit. (Got to live the other half). How do I avoid lowering the scheduled fees to the IRS ?

Thank you again,

Barrie

Andrew,

This article is amazing, thank you. I wish I had found it before struggling to figure out how to open an account myself. I can’t wait to pass it along to my colleagues. Now I need to contribute.

Is there a scenario where it would be more beneficial to make the $61,000 contribution 100% from the employer contribution assuming a spouse is NOT employed? What about of a spouse is employed? Does it matter? Or is it always advantageous to make the 20,500 employer contributions and profit match? Thank you!

Hey Andrew, glad you found the post useful! Regardless of whether your spouse is employed, this scenario might be possible if:

1. you don’t take any income as the employee (or you do but don’t care about paying taxes on it)

2. you have enough employer income to make the formula work (i.e. you can actually max out with 20% net SE earnings)

If 1 is not true, then it might be better to make the individual contribution in addition to the non-elective employer contribution. If 2 is not true, then you won’t be able to max out.

Andrew:

71 years old. College Professor. Can retire at any time. If retired, would still teach as an adjunct, as a 1099 person. Assume $35,000 income from adjunct teaching.

Based on this info, I would be able to put $27,000 (in 2022 limits) into a Solo 401k, correct?

I would use Vanguard. They have all my money now.

You could put into solo 401k, but what’s the point? You’re already near the RMD age. Will you convert to Roth immediately? Also, 401k is good for deferring taxes, but you’ll already get the standard deduction of ~12.5k single, ~25k MFJ on the 35k which is tax-free anyway…why put so much in the 401k?

This post really helped me so much with filling out the form! I called TD but everyone I talked to was very annoyed and rude and really unhelpful so thanks so much for this post!!

So glad to hear it helped!

Hello Andrew,

What an awesome article. Couple of questions concerning the TDA application process. My daughter is a sole proprietor. She is looking to set up a solo 401 and include her soon to be spouse.

1. It seems the easiest way to include a spouse is do it as Qualified Joint Venture. In this case, do both of them request a separate EIN, or do they just use the same one?

2. Do they have to apply at the same time for TDA? Or can my daughter apply first and then add him later?

Again, thanks for the info!!

Neil, ack just saw this. Re: #2, daughter can apply first and then add hubby later. Re: #1, I think spouses can be added to the Solo without needing to have a special corporate form. But it would be best to actually call TDA to verify how they handle spouses since brokerages may differ slightly; I’d also call TDA directly re: the EIN question (sorry don’t know off the top of my head).

Great article Andrew.

I do have a question. Self Directed Solo 401K is the reason I was found you article but you don’t mention “Self Directed” To me it seems as though your discussing a Broker directed account.

I am new to this but don’t you have to set up a trust to have a SD Solo 401K. Then open a brokerage account for the Roth IRA in the name of the trust?

Not so sure about any of this. What I wanted to accomplish was to have real estate investments along with a brokerage account.

Also I did not find a date anywhere so I hope this is still an active discussion.

Thanks

Hey Ed, self directed just means you yourself rather than an employer are administering the 401k account. You still have to open the 401k via a brokerage like TD Ameritrade or Vanguard bc the brokerage actually provides the 401k services and backend you need self administer. Both employer sponsored and self directed 401ks use brokerages – the difference is that an employer sponsored plan is administered by your employer and not you (e.g., employer will probably restrict your investment choices, whereas in a self directed 401k you can invest in anything).

You do not have to specially set up a trust to avail the benefits of a self directed 401k – this is bc the brokerage holding your funds will itself be set up as a trust and will designate you as the trustee. If you want to invest in real estate using a self directed 401k (very common), a quick Google search gives you some guidance:

“It really isn’t complicated…. The new [Self Directed 401(k) plan] will have a checking account. When an R E opportunity arises, the client simply writes a check and the title company titles the property in the name of the 401(k). The client will also write a check for any ancillary fees or “fix up” expenses. If the purchase is a long-term hold, the tenant will pay the rent directly to the 401(k) plan. When the property is sold, the title company will send the profit to the 401(k) plan. The client, acting as trustee of the plan, makes all the decisions for the plan. With a Self Directed 401(k) plan vs. a Self Directed IRA, there isn’t the need for a custodian. Therefore the client (trustee) doesn’t have to submit paperwork or ask permission. He simply makes the decision and writes the check.”

My company has three owners and no full time employees. Currently, I have submitted the two forms described above to TD Ameritrade. Does each owner need to fill out both forms as well, or just the participant info? According to them, each owner needs to “adopt” their own plan. This seems contradictive to what I have been reading online.

I don’t think you can create one Solo 401k plan for 3 people. Even though you three co-own a business, a Solo 401k is for self + spouse max. Each of you would need to create your own Solo 401ks.

In your chart showing how the math breaks down for the $99,030 in Gross Profit, I have 2 questions:

1. You took 15.3% of the $81,030 operating profit and came up with $12,398 being subtracted. Isn’t it supposed to only be $6,199 subtracted because Line 6 on the Self-Employment Tax form is 1/2 of SE Tax, and this deduction is then carried out to Line 27 on the 1040.

2. Right after the chart you write, “$99,030 is the MINIMUM profit you can earn with zero tax liability…just by maxing out your Solo 401k with your spouse,” but isn’t that forgetting the 15.3% SE tax you have to pay?

Great post overall…thanks!

Hi, first of all, great post! It’s highly informative. Under the Employer Information section (Adoption Agreement) what should be typed? Should the individual choose one?

Sorry, I forgot to specify the Account Number field.

For TD, they said I could leave that field blank, so I did. No problems opening the account.

Thank u so much, Andrew. Keep on with the excellent work.

thank you so much! I was trying to open an account and got so confused but your post has helped a lot

Glad to hear it!

There is a section on the first page of the adoption agmnt regarding obtaining a fidelity bond.

If I have no employees is this part necessary?

No.