As those of you following this blog know, I started HYW on the eve of getting married. One post I wrote early on analyzed my income and expenses as a bachelor — from the time I entered the workforce after grad school until I got married in September 2015. I displayed my income and expense trajectory there on a visual, month-by-month timeline.

With a few months of married life now behind me, I wanted to do a lookback post on what I’ve learned about managing my income and expenses. Coordinating my finances with a partner has been a new experience and taught me some useful lessons.

Here’s what happened…

How we’ve been tracking our finances

First, a little bit about how we actually organize, track, and analyze our finances.

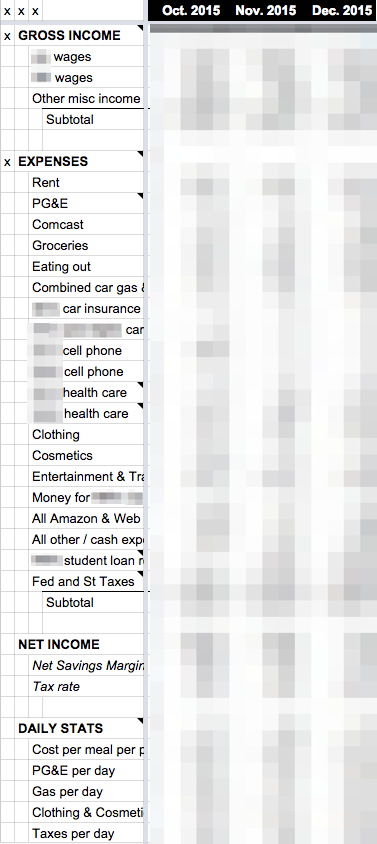

Right now, we use a big frickin’ Google spreadsheet.

Columns are months.

Rows are income / expense items, beginning / ending balances, and reconciliation adjustments.

I structure the top section like an income statement.

The rows are veeeery detailed. Lots of line items specific to us. Looks like this:

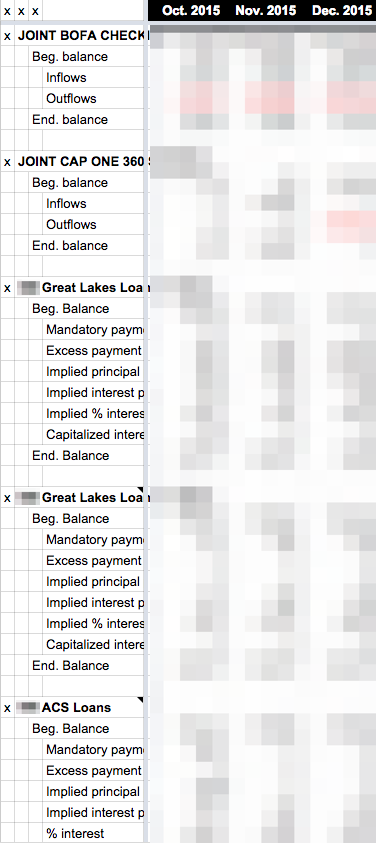

I structure the bottom half as account reconciliations, similar to how a cash flow statement reconciles beginning to ending cash. Each account has monthly beginning, ending, and reconciliation amounts for our various checking, savings, and investment accounts.

We do both income statement and cash reconciliations to understand EXACTLY, down to the dollar, how our cash flow moves and trends month-to-month.

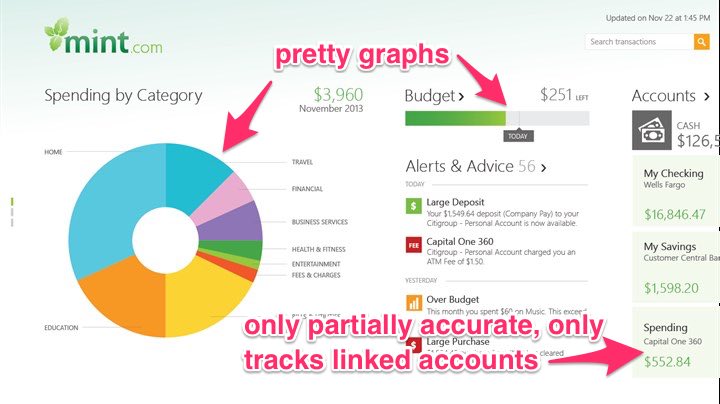

Tools like Mint aren’t smart enough to really do this accurately, insightfully, and custom-fitted for your needs. They give brief ooohs and aaaahs and pretty graphs. But they don’t get enough into the nitty gritty.

They try to automate everything for convenience but they often bucket things incorrectly or don’t allow manual adjustments, and they don’t catch cash expenses or accounts you haven’t linked.

They certainly don’t help you THINK critically.

There’s no substitute for rolling up your sleeves and doing the hard analytical work yourself. At least, not if you want to take total control over your personal finances and understand how to optimize your financial life like a madwoman.

Our spreadsheet has detailed line items for groceries, eating out, utilities, transportation, healthcare, entertainment, clothing, and more. Tracking these buckets individually has helped us understand our daily “unit economics.”

So, we’re able to understand things like:

- How much do we spend on food each day per person?

- How much do we pay in utilities each day, and what’s the variance between low season vs. high season?

- How much do we pay in gas each day?

- On average, what do we spend on clothing each day?

- How much do we pay in taxes every day?

In our spreadsheet, I also annotate many cells with comments on what specific charges were, what certain line items contain, why items spiked or dipped in certain months. This makes it easier to audit later when I do trend analysis.

In particular, I analyze our savings rate. For us, that’s the most important metric for reaching financial independence.

If you’re as interested in attaining financial independence as I am, I strongly urge you to closely track your own savings rate. To retire early, that number will have to be big. Not 10-20% big. Like, 50-90% big.

Seeing your true savings rate for the first time is a revelation. It can also be strong motivation when you see how far you still need to go…or how far you already are!

Early insights I’ve had managing our joint finances

As mentioned above, my first insight is about our savings rate. That’s the first thing I’m interested in once all the numbers for the month get crunched.

When I was a bachelor, I easily saved 50% of my income. I only felt guilty it wasn’t even higher, like 70-80%.

In our first few months of married life, we’ve bounced around a lot in terms of our monthly savings rate. That’s ‘cause we’ve had some large, planned one-off expenses, like pre-paying a big chunk of Kelly’s student loans or paying for our upcoming honeymoon.

So it’s hard to draw a savings rate trendline right now. But I’ll be watching this like a hawk to make sure we stay on track.

The other insights have been the things that impact our savings rate.

Rent is obviously a big one. Rent is like a giant sucking force. It’s relentless. It never stops coming due.

Rent is also craaaaazy in the Bay Area. We’re just in a modest 1 bedroom — no frills, no hip neighborhood, nothing. But the prices still make my nose bleed sometimes.

I’m also surprised by how expensive food is in the Bay Area. We spend more than double what I typically spent as a bachelor.

Sure, I ate JUNK as a bachelor. I eat much better now. And happily. I think that’s a requirement for any sane woman to want to be in a relationship with you.

Kelly makes some spectacular dinners compared to the college burritos I ate before:

But I don’t think we eat extravagantly by any standard. We buy our basic food ingredients from Costco. We go to inexpensive Asian restaurants. We never buy pricey alcohol or gourmet ice cream. And yet our daily food costs are quite a bit higher than I intuitively expected. And, boy, those costs sure do add up.

One of the most eye-opening insights was how much we effectively pay in taxes (through our paycheck withholdings) each day. It’s several HUNDRED dollars every DAY.

Part of my surprise is because we tend not to get much support from the government for anything, yet we pay into the tax coffers hundreds of dollars every day.

Part of it is also because Kelly works for a government hospital, and I see firsthand the bureaucracy and inefficiency and just human laziness, paid for by my tax dollars and yours, in areas of her hospital.

Our tax bill has given me new motivation to be very strategic and efficient in my tax planning to minimize our taxes.

Healthcare is another wallet drainer. We have fantastic health insurance. It’s subsidized by our employers. We’re luckier than 80% of the population in terms of healthcare access that is covered by insurance. And we’re pretty healthy, too. But it’s still a worrying cost, especially since it’s tied to our jobs.

Gas is also costly — even though prices have dropped recently. Maybe it just feels that way to me ‘cause I don’t drive to work — I take BART, which itself adds up. Most of our gas expense is from Kelly’s 50-mile round-trip commute each day. That easily racks up $150-200 bucks a month.

Travel in general is really expensive. Our honeymoon bill make me want to shrivel up in a corner sometimes. It’ll definitely be the trip of a lifetime, but boy is it expensive to travel. Flights and hotels just take you to the CLEANERS.

That’s one reason I’m turning into a travel-hacking maniac: I plan to systematically hunt for EVERY accelerated point signup bonus on earth to never pay for flights and hotels again. I’m so done with that.

I’ll blog about those experiences and lessons later on.

Where we’ve decided to invest our energy

Given the insights I’ve learned in the last few months of married life, I’ve thought a lot about where we should invest our energy to maximize how hard our dollars work for us.

These are my takeaways:

One, don’t sweat the small stuff. It’s not worth stressing out over. A trinket here or there, a nice meal, a gourmet coffee. The small stuff brings more enjoyment in life than it costs in money.

Within reason, of course — if the small stuff happens every day and it adds up to big stuff, that’s not a win, either.

Two, focus on the big stuff. How can you get more efficient with housing, transportation, and general food costs…WITHOUT introducing much inconvenience? These are the biggest expenses for most people.

For us, our philosophy is to buy what’s cozy, not what’s fashionable. We buy what WE need, not what OTHER (more fashionable) people might want.

We live in a great apartment conveniently walkable to everything we need on a daily basis. It’s not a fashionable neighborhood by any means, but it’s safe and cozy with terrific schools.

We drive two ultra-safe cozy reliable gas-efficient unfashionable cars.

We eat healthy, nutritious, cozy meals made with bulk-purchased Costco ingredients.

We go to tasty cozy restaurants under $20 per entree.

And what are we doing with the savings from all this?

We’re paying down Kelly’s grad school debt. That’s first in line (other than keeping our credit card balances at zero) because it’s accruing healthy interest that’s more than what many diversified index ETFs earn today.

Plus, did you know student loans are not dischargeable in bankruptcy? They follow you to your grave. Kelly has 6-figures of it, so our first task is to wipe that off the books. We will chip away at that as relentlessly as rent does for us.

Luckily, Kelly works for a government hospital which, in order to attract top healthcare grads, offers a near-complete, tax-free student loan reimbursement program.

I said, tax-free.

We pay the student loan bill each month first, and then at the end of the year, we get a tax-free reimbursement back for the entire amount we paid over the year. (It’s linearly amortized for 5 years to incentivize talent to stay that long.)

We certainly also plan to save and invest to the max extent we can. We generally follow the personal finance philosophy of “pay yourself first” by automatically deducting from your paychecks to invest in 401ks, Roth IRAs, etc.

It’s prudent to invest your first income dollars every month in YOURSELF before they get spent on other knick knacks. Or simply to prevent it from piling up in your bank account, which earns crappy interest.

But while I strongly believe in the “pay yourself first” philosophy, this year’s gonna be slightly different for us.

We’re still gonna max everything out. But instead of doing it right at the beginning of the year, when I normally do it to benefit from capital appreciation throughout the year, I’m gonna hold off till late spring or even summer.

That’s ‘cause right now we have a shlep of particularly large, planned expenses coming online: we’ll prepay a chunk of Kelly’s student loans before putting them on a smaller recurring autopilot for the rest of their short lives; we’re also splurging a bit on our 3-week long honeymoon, something we both agreed was waaaay worthwhile. 🙂

We’ll wait until about summertime to start aggressively filling up our annual retirement account contributions.

Anyway, those are a few early observations about what I’ve learned managing our joint finances. I’m sure there will be more to write on this topic in the months and years to come.

In the meantime, what about you?

Any insights, tips, reflections on how you transitioned from financial bachelorhood or bachelorette-hood to managing joint marital expenses?

Or, if you’re about to make that transition soon, any thoughts that excite you or scare you?

Leave a comment or question below and let me know!

I enjoy reading your article, very interesting. Great.

Thank you!

Hi Andrew,

This was a great entry – agree with how easy it is to save as a bachelor and how meticulous manually tracking is totally worth it for finances.

Regarding student loan repayments for healthcare professionals like Kelly or Tama above – a great option that is available for Federal loans is the combination of an Income Based Repayment plan with Public Service Loan Forgiveness while working at a state or VA hospital post training. An income based repayment plan limits the drain on cash flow during residency/fellowship years and Public Service Loan Forgiveness forgives the balance on qualifying loans after 10 years of continuous payments so you’re not paying down that deferred compounded interest.

My girlfriend is also in healthcare and since she’s planning on 6 years of training at a lower income (3 years residency, 3 years fellowship), this makes a lot of sense.

Some rough and dirty numbers for a single healthcare professional:

Residency: 50k income per year, 35k discretionary income, 3.5k in payments x 3

Fellowship: 100k income per year, 85k discretionary income, 8.5k in payments x 3

Attending: 200k income per year, 185k discretionary income, 18.5k in payments x 4

After which the balance is forgiven

Total repaid: less than 100k (on a typical 200k loan) not including the time value of deferring those payments. Of course this assumes no marriage (ha) which complicates things so this is extremely simplified.

Best,

Chris K

Wow, thanks for the awesome tip, Chris! I didn’t know about the 10-year Public Service Loan Forgiveness program for government hospital employees — it’s certainly relevant to us because my wife also works for a government hospital. Thanks for sharing the repayment projection for a single professional – I agree marriage complicates things, though… Hope you’re doing well!

Hey Andrew,

Just wanted to let you know that I appreciate this website, especially this post. I’ve been trying to figure out ways to get my girlfriend (we’re both residents in pediatrics) to understand why she needs to be saving for retirement (at all), paying down her credit card debt, and refinancing her loans. Your articles will come in handy. Thanks for doing good work!

Cheers

Hi Tama, thanks for your nice comment – and glad you’re finding HYW helpful! Yes, coordinating finances with another person, especially if you’re looking toward the long-term, is an important skill to develop, and I agree it’s very worthwhile to convince your partner to pay down (especially) credit card debt and invest in retirement. Since you’re both doctors, you have a very stable and bright career / earnings outlook. 🙂 But setting good personal finance habits when you’re younger will pay big dividends when you get older, so keep that up. 🙂 Good luck and stay tuned for more great posts on HYW!