Today I’ll share a framework for how to think about the cost of college.

If you’re a parent, this affects you because the cost of college in the U.S. will reach truly epic levels over the next two decades.

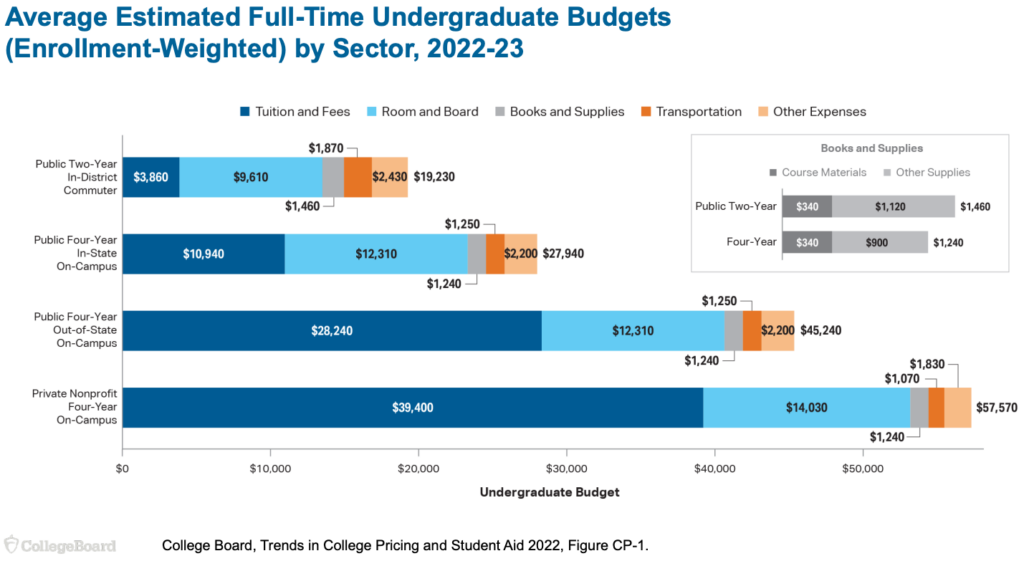

Right now, the average cost of a public in-state 4-year university (tuition, room, board) is $28k per year. Private universities, $58k per year.

When I was in college, it was $12k per year public, $32k private (in today’s dollars).

Source: The College Board

Clearly, college is much more expensive now. And rising with each passing year.

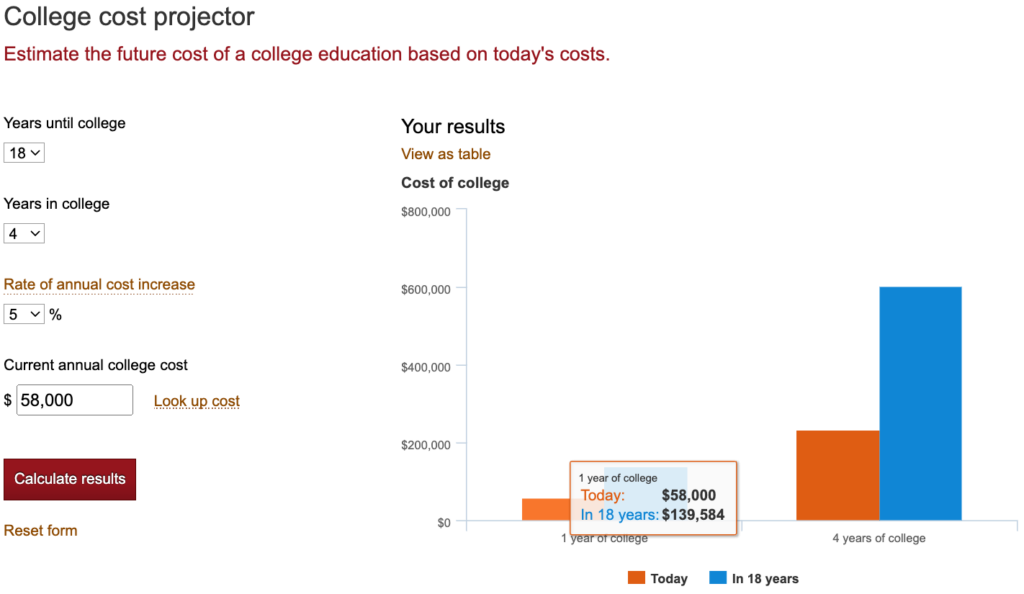

In fact, if you think college is expensive now, try not to get a nosebleed thinking about how much it’ll cost for a kid born today: in 18 years in-state college will set you back $67k, private university $140k.

PER YEAR.

Use Vanguard’s college cost projector to test different scenarios yourself.

No wonder it was such a big deal when a billionaire investor pledged to personally pay the student debts of one class of graduates of Morehouse College.

And why democratic proposals (like this and this) to cancel student loans get so much buzz.

Given the astronomical cost of higher ed, how do you make sure:

- the cost of college doesn’t drown your kid in debt for life

- your kid actually gets educational value useful for their career?

That’s what this post will show you.

First, let’s understand exactly how the college debt burden impacts your kid

Given the cost of college, it’s no surprise students take on lots of debt.

Debt they struggle to repay. Debt that follows them for years, even decades.

The average college grad today graduates with $30k debt.

On average it takes 21 years to pay back. (Unsurprising given new grads earn only $55k on average.)

That’s 21 years of delayed retirement investing, homeownership, wealth building.

Half your working life!

Even though investing from an early age is the most important factor for building retirement wealth.

To make matters worse, wages simply have not risen much: over the last 40 years, the top 1% captured vastly greater wage growth vs. everyone else:

The gains have accrued to the top.

How do other advanced countries compare?

When you look at our peer countries, you quickly see the high price of college charged by American universities is not exactly necessary, because higher ed in many advanced countries is a bargain by comparison:

- UK: ~$12k max tuition (any university), ~$11k room/board, total $23k per year

- France: effectively free tuition (~$200 per year), ~$10k room/board per year

- Germany: free tuition, ~$9k room/board per year

- Japan: ~$7.5k tuition/fees, ~$9k room/board, total $16.5k per year

- Canada: ~$5.2k tuition, ~$11.5k room/board, total $17k per year

- Australia: ~$7.5k max tuition (any university), ~$14k room/board, total $21.5k per year

In other words, our peers only charge their citizens, at most, roughly what the U.S. charges for in-state public universities.

And most charge less.

Why can’t we make higher ed as affordable as our peers do?

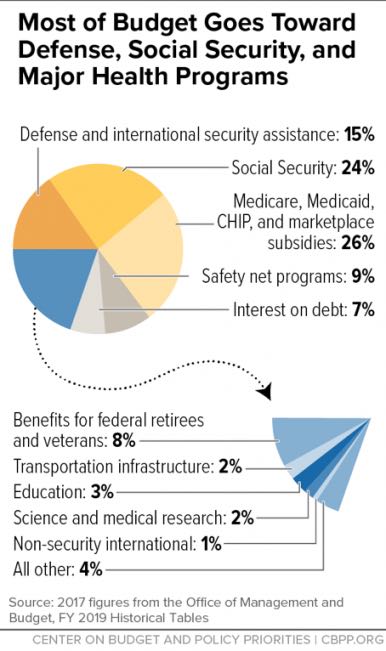

One big reason is we hardly spend any national budget on education: just 3%, and that’s mostly for k-12 programs.

By contrast, we spend:

- 26% on healthcare (Medicare, Medicaid, etc)

- 24% on Social security

- 15% on military

- 9% on safety net programs (welfare, job training, etc)

- 7% on interest on national debt

So, we spend >2x on debt interest vs. education.

5x on military vs. education.

Really.

By contrast, our peers spend:

| Country | Education | Military | Debt Interest |

|---|---|---|---|

| Canada | 12% | 8% | 8% |

| UK | 11% | 6% | 7% |

| Australia | 7% | 6% | 3% |

| Germany | 7% | 2.2% | 2.8% |

| France | 5% | 3% | 2.5% |

| Japan | 4% | 1% | 23% |

| US | 3% | 15% | 7% |

In other words, Japan excepted, other nations spend 2-4x on education relative to their national budgets compared to us.

Maybe you’re thinking, “well, other nations don’t have to spend nearly as much on military because the U.S. pays a hugely disproportionate share of the world’s military budget…so of course they can spend more on education.”

That may be true, but it still only explains part of our underspend. We create plenty of self-inflicted wounds.

For example, it doesn’t help that the Department of Education’s budget has been slashed by $9B from $69B to $60B under Trump, while Trump’s Tax Cuts & Jobs Act has handed out huge tax cuts to the richest taxpayers and corporations.

Stuff like this evaporates education dollars, plain and simple.

How to make sure college doesn’t drown your kids in debt and regret

So let’s say your kid isn’t one of the lucky few to have her college debts erased by a billionaire or canceled by a politician.

As a parent, you can still prepare them so they don’t drown in debt after graduation and you can teach them the right mindset to get maximum career-boosting value from college so they don’t regret their choices there.

Here is how:

1. Teach your kids about money early (use a budget on them). Earning, budgeting, saving, investing. Teach them about these early, often, and ongoing.

Your kids will not only learn about the value of hard work, but also about how to manage their money to take control of their own future.

This is the single most important thing you can do to prepare your kid not to make stupid financial decisions (including when it comes to higher ed).

Your kids will thank you later. Especially because student loans are one of the only types of debt you cannot discharge in bankruptcy: they follow you until the day you die.

That’s one reason I urge paying them off asap, right after any credit card debt.

One way some parents have found effective to teach their kids good financial habits is to give them clear budget constraints.

Parents cover the basics; everything else is on the kid:

- “You get an allowance for good quality inexpensive essential clothes, but if you want the fancy brand-name jeans, you have to budget for it; no extra money for that.”

- “You get a weekly budget for cafeteria lunch; if you want to eat off campus, you have to make it work within your budget.”

- “We’ll give you a used, safe car, but you are responsible for insurance and gas.”

I like this strategy because it empowers your kid to make their own choices – and live by the consequences – while teaching them to develop an “owner’s” mindset so they learn to prioritize goals most important to them.

And they learn to manage money from a young age.

2. If you decide to help pay for your kid’s college, don’t tell them. Even if you’re putting money away in a 529, you don’t have to tell them.

Otherwise it becomes an expectation. Just do it at the final moment and watch their happy grateful faces smile back at you.

Better yet, make your kids actually take out student loans to feel the pinch of education not being free.

They’ll take it 1000% more seriously – and be much more likely to graduate and excel – if they internalize that they’re paying for it.

Then, if you decide to help them, do it after they graduate.

Put conditions on it, too, to continue reinforcing good financial habits.

“For the first three years (only) after you graduate, we’ll match your student loan repayments dollar for dollar, on the condition that you also max out your 401k, Roth IRA, etc, each year.”

This would incentivize both a habit of retirement savings from the very beginning of their career and accelerated pay back of student debt.

3. Nudge your kids to pursue their passion…as long as it’s also coupled with something practical. Two-thirds of U.S. college grads regret college because they majored in something useless. Meanwhile, their debt grows like a weed.

But that regret isn’t universal.

STEM majors carry the least regret, both about their majors and about incurring student loans.

That’s unsurprising given the high salaries earned by STEM grads.

For engineering and computer science grads, only 8 and 4 percent regretted their major.

By contrast, three quarters of humanities grads regret their education, half regretting their major and half their loans.

This is why my advice to college-bound kids is, if you must major in art history or philosophy or theater, at least double major in engineering or finance or CS. (Or prepare to go to law school or business school.)

The more useless your major, the more practical your other major should be.

4. Teach your kid to love learning (here’s how to do it). This is the hardest but most important.

The only way for your kid to excel on her own merit is to develop great intrinsic motivation.

Your kid must be very self-motivated to get maximum value from her education and parlay it into future opportunities.

Your job as a parent is to use every tool in your box to spark that motivation so it becomes self-sustaining.

The same way you’d nurture a flame to sustain and grow into a fire.

I can’t exactly define for you “great intrinsic motivation” but I know its characteristics:

- a love and hunger for learning

- strong almost insatiable curiosity

- laser focus when you’re passionate about a thing

- ability to reach a state of flow easily when you’re working on something you’re interested in, etc

Students who have these characteristics display confidence, a natural tendency toward excellence, a natural tendency toward leadership (thought leadership, people leadership, etc).

This is hard to achieve, and hard to teach. There’s no secret formula.

The most parents can do is to create the conditions where that flame has the best chance of igniting.

And all evidence points to reading aloud with your kid when they’re very young – early, often, continuously – as the single most impactful thing you can do to get them on the right footing early in life.

It greatly increases the odds of their developing a love for reading, and self-motivated reading is the critical lifelong way to acquire new knowledge.

The second thing is to give your kid some but not rigid structure to explore and discover what they enjoy, what they’re good at.

In my view, this means structured pushing at the very beginning to get them “off the ground.”

That is, providing structure so they stick around past the early basic unpleasant initial learning hump.

And motivating them with deep positive encouragement, not scolding (or else they’ll come to hate the thing because it’s a fear-driven chore).

Clearing the early basic unpleasant initial learning hump is critical to get to the fun stuff, the stuff that makes a thing exciting, the stuff that easily and naturally creates self-motivation.

You know what I’m talking about.

Practicing guitar scales repetitively is no fun, but the skills they teach are critical to strumming your favorite songs and improvising new ones (which is fun).

Doing ice skating drills all day isn’t fun, but being able to use those skills to create beautiful performances where everything flows is exhilarating.

Memorizing chemical formulas and medical facts isn’t fun, but synthesizing that knowledge to come up with innovative theories and insights that advance medicine is exciting and addicting.

Every field has its “10k hours” concept – that early basic unpleasant initial learning hump.

And you have to get over that hump to get to the juicy stuff.

The juicy stuff is intrinsically self-motivating.

And parents play a critical role in keeping their kids on track as they work toward clearing that hump.

It doesn’t matter if it’s for chemistry, spelling bees, calculus, computer programming, science, gymnastics, piano, boy scouts.

What matters is that your kid clears the hump.

That’s what unlocks true sustaining self-motivation.

And that in turn drastically increases the chance your kid will achieve excellence/leadership at the thing.

College still matters, but not for the reason you may think

For all the gripes about the astronomical cost of college, it still has really important value.

But it is not educational.

After all, given the plethora of online self-learning options these days (Coursera, Udacity, Udemy, LinkedIn) that teach high-demand practical skills for a tiny fraction of the cost of a four-year degree, you don’t strictly need college to set yourself up for a comfortable, happy life.

The real value of higher ed, especially at elite colleges, is networking and branding.

Harvard, for example, has so much cred it opens doors that might be firmly shut had your entire education been acquired from YouTube…even if the stuff you learned was exactly the same.

A strong university brand signals a high minimum achievement bar, hard work, logical thinking, and intellectual rigor, which in turn lowers the risk for an employer betting on an unproven candidate.

Moreover, someone from an elite university can call on alumni network connections to help her gain a foothold in a new industry.

Alumni networks can be vast and powerful if leveraged thoughtfully.

They are a tremendous asset that you get automatic access to just for being a graduate.

Not only that, you might meet your future spouse at an elite college, which then reinforces/multiplies your network and maybe even gives your future offspring a legacy advantage when it comes time for them to apply to your alma mater.

If you think about it, that’s why in the recent college admissions scandal rich actresses, CEOs, and financiers bribed a corrupt college consultant and university staff millions to get their privileged, mediocre kids (like Olivia Jade) into prestigious colleges.

It’s not that these trust-fund kids needed college to do well financially – their parents are already exceedingly rich.

It’s the brand and network the kid gets access to that makes even rich parents obsess over elite admissions to a point where they have to cheat to get their kids in.

So for the masses of families with no such advantage, things are just that much harder.

That’s why it’s important to take college seriously, and given the high cost, why it’s important to teach/guide your kids so they don’t make dumb higher ed decisions that, additionally, drown them in debt.

Now I’d like to hear from you

Did this framework help you think about how to guide your kid so that the cost of college doesn’t ruin their future?

Do you agree with the framework? If not, why?

Is there something you think should be added to it?

Or maybe you just have a question about something you read.

Either way, let me know by leaving a comment below right now.

Related: Check out the best parenting guidance I’ve learned for raising successful children.

Join a skilled trade, $66K plus benefits by age 22, no college debt. Start earning at 18 or 19. We have more jobs than we have skilled people to fill them. Oh, but you have to show up everyday, on-time, work occasional overtime and do it sober. There are too many worthless degrees that can not support the accumulated college debt required to earn them. Figure out how much you need to make per year, find out what jobs pay that much, then find out how to get the skills for the least amount of time and money (if any) required to secure those jobs and get to work.

Students who graduate from a St. Paul high school and can pass the ACT can go for free for two years to St. Paul College, earn an AA or industry certificate and start at $60K plus per year if they choose the right vocation. Four-year liberal arts colleges are a dinosaur from the 1900’s and the elites of their time. No working class people sent their kids there. Those who graduated had jobs in the family business, law firm or lived off old money like former MN Governor Mark Dayton. Now middle class folks send their “B” student there and rack up $100,000+ in school debt, only find jobs at Target and Starbucks with their English Lit and Philosophy majors. Saddled with the equivalent of a mortgage but no house. Wake up America.

j