K and I recently bought an investment property to house hack. This is the 8th and final post of a new series on strategy and tactics for how to house hack in an expensive market, using our own example as a case study.

Throughout this house hacking series, I have shared our most important lessons for finding, analyzing, purchasing, and remodeling a multi-family apartment building. Multi-family real estate is a very effective way to build wealth: through cash flow, appreciation, and tax deductions.

Last time, I shared our battle-tested tips for getting the most from your contractors and our best hacks for saving serious money during your remodel.

Now after all the hard work, it’s time to make some money!

In this final post, I share our best tips for finding awesome tenants who pay market rent on time.

How to find great tenants

Pricing your rent attractively certainly helps. But setting it at market level, or even above market if your rental warrants it, shouldn’t hurt.

Just like finding the right house or contractor requires filtering through lots of candidates, finding a great tenant requires maximizing the number of potential renters who see and like your place.

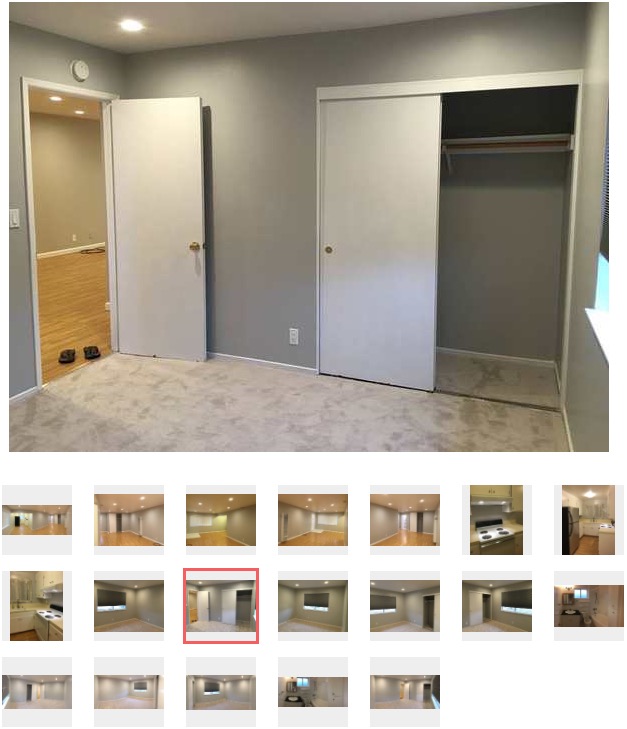

1. Take high quality photos. The most important thing you can do to market your listing is to take high quality photos. Good photos draw in good renters.

You don’t need an expensive camera. Your iPhone or Android phone will do just fine. Just make sure to get some nice wide angles and the rooms are brightly lit. Stand in the corner or doorway of each room and shoot diagonally to get the widest view.

Like this:

Consider panoramic shots to make the space seem bigger:

Although you may not use all the photos, take a ton of them anyway from every corner of the house. Landscape, portrait, panoramic – get them all.

Then you’ll have a nice little photo library you can use over and over again for different purposes.

When you post the photos in your online ad, I suggest ordering them in a logical way similar to how you would actually walk through the house. Make it easy to follow the path from photo to photo.

2. Use vivid words. Use bullet points in your ad to make it easy to scan. And use vivid, visual language to describe the space (especially remodeled features).

Example: don’t say, “new recessed lights.” Say: “newly installed recessed lights give living room elegant museum look to showcase your wall art.”

Don’t say: “new vinyl windows.” Say: “new double-pane windows keep unit cool in summer, warm in winter (saves electricity costs)”

Describe every attractive feature and pre-answer as many questions that someone who knows nothing about your place would want to know. Not just number of beds / baths.

Does the place have high ceilings? Hardwood floors or carpet? What appliances are there? Gas or electric stove? Shower or bathtub? How large are the rooms? How’s the natural light? Walk-in closet? Is laundry inside or outside the unit? What floor is the unit on? Backyard space? Extra storage space? Parking situation?

Your goal with the ad is to get potential renters curious and motivated to get off their butt to view your unit in person.

Be sure to also mention any hard criteria you have, e.g., minimum income and credit score requirements. You want to filter out unqualified prospects quickly.

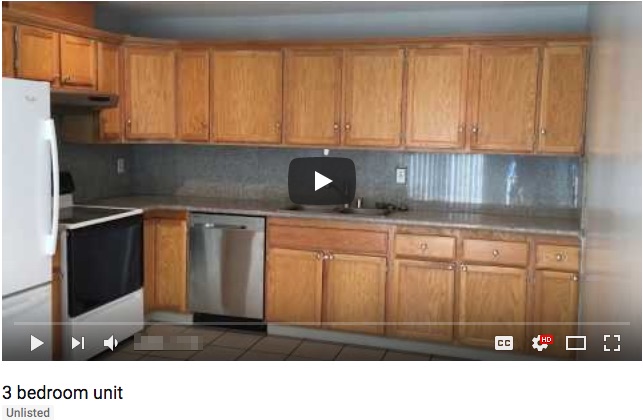

3. Include a video tour. I’ve talked about this multiple times (here and here). You did record a video walkthrough of the unit right after you finished remodeling, right?

Now is the time to use it. Upload your video to YouTube (you can make it a private or unlisted link). Paste that link in your online ad.

Such a simple thing, but almost no landlords do this, even though it’s HUGE value-add. Having a video for tenants to watch saves time because they get a good feel for the unit even before they visit it, thereby minimizing surprises and mismatched expectations. It also saves YOU time from scheduling showings where the tenant takes one look and in two seconds realizes it’s not what they want.

Plus, including video makes you seem more thoughtful because you cared enough to include it with your descriptive, well-written, well-photoed ad. It shows you cared enough to spend the time to provide the clearest most comprehensive info possible for a tenant to make an informed decision. This will help you attract higher quality tenants.

One time, I even had a tenant agree to rent a unit and sign a lease solely based on my video. They never saw it in person; they moved from out of state. And they were one of the best tenants ever.

Point is, video is much better than photos or text at showing the space and showing details the tenant wants to know about before deciding whether to commit.

4. Show nearby amenities. A good way to show the value of your property is to show nearby amenities.

A visual way to do this is to superimpose logos for major grocery stores, companies (employers), restaurants, retail stores, etc, on a picture of a map that are located near your property. Kind of like the way you can see local stores and businesses when you zoom into Google Maps.

This gives renters a clear sense of why your unit is desirable and convenient. If you don’t want to use a picture map, you can just write a bullet point list of nearby amenities, categorized by groceries, restaurants, employers, etc.

Financial rewards

Rents are crazy in the Bay Area, and one major goal of ours is to control our own destiny in terms of housing costs.

Before we moved to the 4-plex, we paid well over $2,000 per month for a humble 1 bed apartment in a mediocre part of town. It was spartan, no frills / amenities, located in a boring area, and paying rent every month was a money drain. We also knew rents could increase every year.

If we had bought a single family home, it would produce no income while we lived there, only suck money out to cover mortgage, costs, and taxes.

But with our 4-plex house hack, we live in one unit and rent out the other three. The rent collected covers the entire monthly mortgage payment; we split common utilities evenly across everyone in the building, so everyone has an incentive to be mindful of utility costs.

The only major expense not covered by tenant rents is the annual property tax bill. In California, property taxes are high, but here they are still several hundred bucks less per month than our previous 1 bed apartment rent. More important: they are stable and predictable, unlike rents which can increase significantly.

So in terms of monthly cash flow, it’s as if our rent dropped from well over $2,000 per month for a 1 bed apartment by several hundred bucks every month for a nicer, newly renovated, larger 2 bed unit. That savings repeats itself every month.

In addition, our wonderful tenants pay rent which covers the monthly mortgage and builds thousands in equity wealth for us every single month.

We don’t even have to wait until the mortgage is fully paid off to start taking money off the table. As the mortgage is paid down, we can ask the bank to “recast” the mortgage. This lowers the monthly payment while keeping the same low interest rate and payment timeline. That allows the property to cash flow faster.

Rents will also increase over time, while the mortgage won’t (and property taxes increase only very minimally by California statute). One day, after we move out, we’ll rent out the unit we’re currently occupying. That fourth rent payment will cover the entire property tax bill and even produce modest cash flow back each month. So when we move, the property will not only break even – it will actually make money. And every year, the amount it makes will grow.

Meanwhile, the value of the property itself, and the land it sits on, will appreciate over time. And we’ll happily take those depreciation and mortgage interest tax deductions every year, thank you very much.

Even though there is now a $10k cap on state, local, and property tax deductions under the new tax law, that restriction only applies to personal taxes. Here, three of our four units in the 4-plex are business property, which has no deduction caps.

Eventually, when the mortgage is paid off, the rents will be our retirement pension to travel the world or just chill out. On top of whatever social security and retirement investment accounts we have (still max those out every year).

And that is how wealth is built with real estate.

Lessons learned

Throughout the past months as we undertook our 4-plex project, we learned two key lessons.

1. Getting an apartment deal done is really hard. The rewards seem awesome right? But landing a deal where the numbers work in an ultra competitive market is, well, really freaking hard. You have to be creative. Persistent. And hustle your ass off to get the deal done.

You also better have a stockpile of cash to get the project started. If the numbers work, eventually you’ll make money and build wealth, but realize it’s not cheap to get started. You’ll need cash – lots of it – to handle the startup costs (down payment, remodel, carrying costs). That’s the biggest entry barrier, I think, to would-be investors. So save up!

It’s also hard because you’ll fail a lot. But if you fail the first time, second time, third time, 10th time, keep bidding. Stay at it. If you work hard and are very determined, you will eventually get deals done even in an ultra competitive market. It may not be immediate, but hustling eventually turns the odds in your favor.

2. Have a spouse? Remember, it’s a partnership. If you have a spouse or partner, don’t forget real estate investing is a partnership with them. You have to stay aligned with your partner throughout the whole process.

When things get hard, when you don’t see eye to eye, when there’s friction – talk things out. Analyze the tradeoffs for tough decisions. Do it together. You have a better chance of seeing all the angles, all the risks, if you work together and help each other. For big money matters like this, two heads really are better than one. You’re going to need each other’s support throughout the journey of owning and operating the property, so watch each other’s backs.

Check out all the posts in this series:

- House Hacking San Francisco Bay Area style (how we’re creating real estate wealth by having others pay our mortgage on a multi-million dollar house)

- How to research real estate markets (the single best resource you need)

- How to do a residential property inspection step by step (what smart real estate investors look for)

- How to write an offer to purchase a house (that stands out and wins)

- How to minimize rental vacancy before you close on a new rental property purchase

- How to find and vet good contractors like a boss (for home remodeling and repairs)

- Battle-tested home remodeling tips for saving serious money and getting the most from your contractors

- You are here: How to find great tenants for your rental property in 4 simple steps that take 1 hour or less

Plus: make sure you think about your real estate tax strategy from the very beginning. Check out my post on how to avoid capital gains taxes when selling your house to get up to speed.

Also: learn from some of the best real estate investors in the business from our post: 18 real estate investors share what they wish they knew at college graduation.

Discussion: If you’ve owned investment real estate, especially multi-family, what key lessons have you learned? What tips have you found helpful to find great tenants? Leave a comment and share your thoughts below!

Great article. If down payment is 20%, how much extra should you budget for renovations and carrying costs? Also, is it possible to make the math work on duplex or triplex in your experience?

^ in Bay Area or other competitive market

It’s definitely possible to make it work for a duplex or triplex: it really just depends on how much you can purchase the property for vs. the rental economics. In general, the more units in the building the better the economics, simply due to scale. In the Bay Area, it’s generally hard to make the economics work with, say, a duplex. In Southern California, it might be easier but I’m not as familiar with that market.

In terms of how much to budget for renovations, there isn’t a one size fits all rule. The more renovations you need, the cheaper the initial purchase price should be. The higher the purchase price, the more turnkey it should be. What really matters is the all-in cost (purchase price + renovations) compared to the rental economics.

In terms of carrying costs, you can estimate these as a % of purchase price. In California, for example, property taxes are usually around 1-1.5%. You can also estimate maintenance and insurance using reasonable % assumptions.