K and I recently bought an investment property to house hack. This is the 4th post of a new series on strategy and tactics for how to house hack in an expensive market, using our own example as a case study.

Last time, we talked about how to do a residential property inspection. But after you’re done with inspecting and ready to write your offer, what’s the best way to do it? What will maximize your chances of success?

In this post, I’ll share how we strategized and crafted our offer. I’ll also share the controversial strategy we used to hire our real estate agent, how we worked effectively with our agent despite conflicts of interest, and the lessons we learned from it all.

The importance of standing out

The strategy for writing an offer depends heavily on how competitive the market is. In a buyer’s market, much of my advice below won’t apply because, frankly, you don’t have to work as hard or impress as much to get your offer taken seriously.

But at time of this writing, most major real estate markets are seller’s markets, not buyer’s markets. Many have inventory shortages.

This causes competitive pressure as buyers try to take advantage of historically low interest rates, homeowners hold their homes for longer, and many buyers and investors seek to take half-decade long stock market gains off the table and diversify into more stable, inflation-hedging real estate.

In this environment, where buyers are clamoring for limited inventory, making your offer stand out is critical.

If you can afford to pay the highest price, you certainly have an advantage. But often paying the high price makes no economic sense whatsoever. Meaning, paying that price means there is no chance you’ll recoup your investment in any near-term timeframe.

On the flipside, if your price is too low, no amount of enhancement to your offer will help.

But if your offer isn’t the highest one, yet still reasonably competitive (e.g., within a few percent), you have a real chance to win. But you have to stand out.

This post focuses on that group of buyers.

What’s the best way to make your offer stand out?

(1) Get clear on who the seller is. Tailor accordingly. If your seller is an individual owner-occupier, you should use a very different approach vs. if they’re an investor and the unit is perhaps just one of many rental properties they own.

For investor sellers, making your offer stand out is actually really simple. The levers you can pull are:

- Submitting a “clean” offer with few or no conditions

- Ability to close quickly, within days vs. weeks or months

- Bringing lots of cash to the deal, either all-cash or low mortgage need (thereby reducing appraisal and financing risk)

- Getting your loan completely pre-underwritten, not just pre-approved or pre-qualified (banks in competitive markets allow this)

- Absorbing cost/work of dealing with renovations and repairs if seller doesn’t want to deal with them

- Agreeing to inherit existing tenants so seller does not have to evict

- Cooperating with seller’s 1031 exchange

Basically it comes down to minimizing seller hassle: you can remove the risk that you’ll back out or be unable to close, or remove the seller’s hassle of dealing with home repairs and preparing it for sale.

For owner-occupier or individual sellers, all the above levers still apply, plus you have some additional ones:

- Creating a highly personalized offer package (see how below)

- Tugging at seller’s heartstrings: showing you’ll take excellent care of the house just like they did, showing you want to build a life there long-term (e.g., raise your family there)

- Getting sellers to see a little bit of themselves in you

(2) If appropriate, create a multimedia offer package. This is only worth doing if the seller is a person (doesn’t matter if they’re owner-occupier or investor). It’s not worth doing if the seller is an LLC or some kind of investment entity.

Either way, your offer should pull as many levers above as possible. But if the seller is a person, I recommend additionally including in your offer:

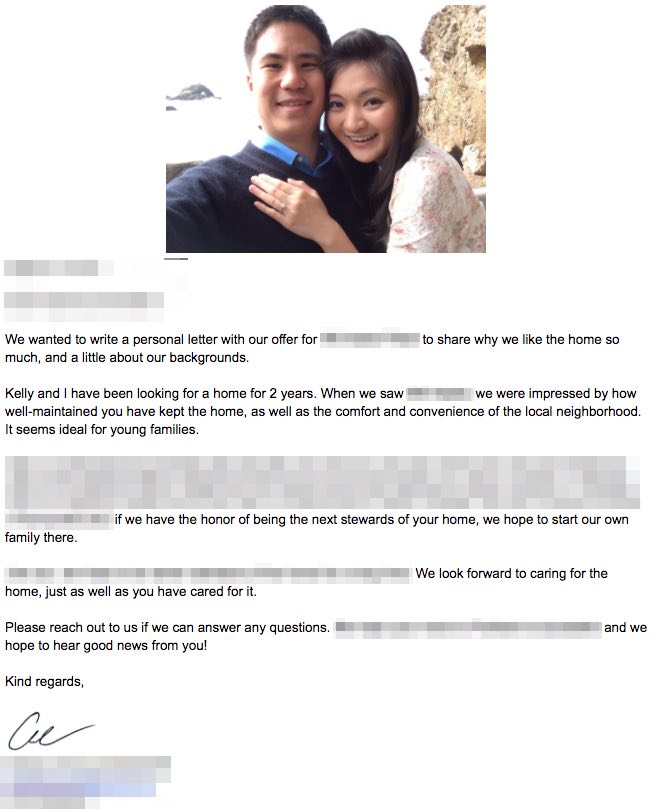

- A thoughtful cover letter that explains some combination of: (a) who you and your spouse are; (b) 2-3 specific reasons why you love the property; (c) how you hope to continue caring for the property just like the seller has done; (d) your vision for building a life and raising a family there (if you intend to owner-occupy). You get the idea. Show you care by going the extra mile. It matters.

- At least one happy “couples” photo pasted right above where your cover letter begins. Do this to put a face to your message. It’s a lot harder to say no to a smiling, earnest, hopeful couple whose endearing photograph is pasted at the top of the cover letter than it is to say no to a vanilla letter with just black and white text on it.

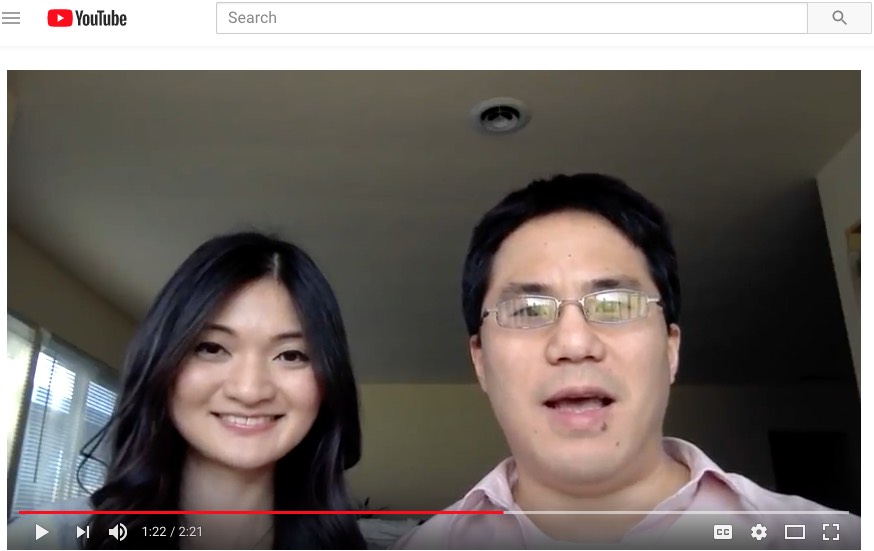

- A well-shot video uploaded to YouTube introducing yourselves and supplementing your cover letter. I recommend loosely scripting out your video talking points so it flows and has structure, but not memorizing it word for word. You don’t want to sound stilted or rehearsed. Leave enough flexibility to improvise and let your sincerity shine through.

Some people think recording a video is overkill. I don’t. It definitely helped us win our 4-plex, even though we were not the highest bidder.

It didn’t take long to put together, either. 20-30 min to think up / jot down talking points, another 15 min to record a few takes. Less than 1 hour total. And I’m pretty sure no one else took the time to do that. It made us stand out.

Plus, the video doesn’t have to be fancy. You can do it for cheap using your phone and a selfie stick, and then upload it directly to YouTube.

The purpose of doing video is to give the sellers a unique and better sense of you as a couple / future owner.

Much more than an earnest photo pasted on your cover letter, video puts a face and voice to your offer. It makes you more human. It makes you more relatable. And if you have a spouse by your side, it also conveys a family feeling.

In every way, video communicates more than a photo and letter ever could. If a picture is worth a thousand words, video is worth a thousand pictures.

But: even if you do video, still do a photo and cover letter. The seller may run into technical problems viewing. Or they may prefer printing and reading a letter. They may share your printed letter with their spouse, but not bother to share your video.

Ultimately, you don’t know how they prefer to engage, so you should “meet them where they are” by using multiple media formats to personalize your offer. Create as many chances as possible to make yourself seem more human and tug at their heartstrings.

(3) Consider hiring the seller’s agent to represent you…but watch your back. I decided to hire the seller’s agent to represent me for the 4-plex deal. There are many conflicts of interest that can hurt you by doing this, but the simple reason we did it is that we kept losing bids elsewhere.

We tried lots of different methods before deciding to hire the listing agent:

- Traditional agent. Our original agent was very good, very resourceful, responsive, extremely knowledgeable about the area. We liked working with him a lot and we wrote many offers with him. But we lost them all.

- Discount agents. We tried Redfin (variable commission refund), Open Listings (50% refund), and Reali (100% refund minus flat fee), but all of them did not meet our needs.

- I used to work at Redfin so I am very familiar with their brokerage model; many Redfin agents are good, but not all, and end of day my traditional agent was still better and more resourceful and tenacious than a Redfin agent.

- Open Listings had an interesting 50% refund model that provides nearly full service. But to interact with one of their agents, you must first upload all your financial documents and mortgage approval. So basically only serious buyers can talk with their agents, not casual browsers. I found their agents to be competent if given explicit instructions, but they were not very creative or resourceful in making a deal happen.

- Finally, we tried Reali, a new SF-based brokerage startup that refunds 100% of the commission, minus a flat administrative fee. (In the Bay Area, houses are so expensive that the administrative fee isn’t material.) I found their agents to be underwhelming by every measure. Not insightful, not helpful. They say they are full service, but they’re really best suited for customers who do 100% of the legwork and simply need someone with a real estate license to officially write the offer. You get what you pay for, and in this case you’re paying simply to use their brokerage license as a rubber stamp for your offer. Like Open Listings, you have to upload your financial and mortgage approval docs before you can interact with one of their agents, and once your mortgage pre-approval expires, they stop interacting with you until you update it again.

- Get a real estate license? I briefly considered even just spending a weekend studying to get a real estate license, but pretty quickly ruled that out as ridiculous. It cost money to get a license, it takes several weeks’ processing time, and it wouldn’t fundamentally solve the problem I had: making my offer stand out.

So that’s why we decided to start asking listing agents to represent us as buyers and double dip both sides of the commission.

This is definitely an important reason why we won the 4-plex.

Advantages of hiring the listing agent

There are certain key advantages you get by letting the seller’s agent represent you. The most important one is that the agent is super incentivized to help you make the deal happen.

In our case, for example, the agent flowed a constant stream of info and updates to us right up to the offer deadline. He definitely nudged our offer to the top and positioned it super favorably to the sellers. He even delayed sharing a last-minute stealth cash offer he got right at the offer deadline which was actually higher than our offer.

In the end, there were 6 offers total. We were not the highest bidder. At least 2 offers came in higher. More than half were all-cash. At least 3 offers had short 2-week closes. I know the sellers wrestled hard with these other offers.

To be sure, I’m pretty certain we were the only buyers who invested the effort to send photos, video, and a cover letter. For 4-plexes, the buyers are almost always investors, usually LLCs.

We were lucky in this case because the sellers happened to be owner-occupiers, so our cover letter and video actually had an impact. Usually 4-plex sellers are investors who are not moved by emotional appeals.

But even with us going the extra mile, I still know the agent had a MUCH stronger incentive to push our offer given his chance to earn both commissions for the same amount of work.

I think that helped to tip us over the edge.

A double-edged sword: conflicts of interest

The big risk to having the listing agent represent you is the conflicts of interest involved.

The conflicts are many and ongoing and you can never completely trust your agent has your best interests in mind. You have to be especially careful and scrutinizing of anything they ask you to do.

In fact, unless the agent happens to be so well-established in the market that your deal makes no real difference to their personal bottom line, they’ll likely push to close the transaction even if it’s not good for either side.

Maybe the buyer didn’t offer the best price or terms. Or maybe the agent knew of a different house better fitting the buyer’s criteria but didn’t tell the buyer because the other house was represented by a different listing agent. Or maybe they played down the seriousness of a needed repair so the buyer wouldn’t get spooked and back out.

The more commission money is as stake, the more distorted the incentive is. And in very expensive competitive markets like the SF Bay Area or New York City, it can cause the agent to do some truly weird things.

In my case, our agent did things he should not have done that helped us. He also did things he should not have done that may have hurt us. I say “may have” because I’ll probably never know for sure.

Examples where the agent helped us

Example 1. When the seller’s agent receives offers from buyers, he isn’t supposed to share details of those offers with anyone but the seller, even if he’s representing one of the buyers. Otherwise it would be a breach of fiduciary duty.

But in our case, the agent freely shared offer prices, terms, cash vs. loan details, and contingencies with us for all the offers. This definitely gave us an edge. It allowed us to revise our offer to make it more competitive. We didn’t revise the price, but we did throw in some sweeteners, like a leaseback, which made it easier for the sellers to say “yes” to us.

Example 2. At the last minute before the offer deadline, the agent called and told us there was another offer that just came in at the wire $20k over list, all-cash, 2-week close. Five minutes before, the seller had emailed us a conditional acceptance on our offer if we agreed to a few final minor terms.

I say “conditional acceptance” but it actually wasn’t even official. The seller simply wrote us an email saying they would accept if we agreed to a few minor terms, but an official acceptance requires signing the offer contract itself because the contract is what actually contains the terms and conditions of the offer.

Despite no official acceptance, just an informal email “handshake,” the agent (who I’ll remind you was representing both of us) did not even share that last-minute $20k-over offer with the seller first. Instead, he told us about it first and urged us to reply to the seller’s conditional acceptance email quickly to accept the minor terms.

That’s really messed up.

While it helped us get the deal, it was pretty unfair to the sellers who were his clients too.

Examples where the agent hurt us

Above were things that made me question our agent’s agenda.

There were also things he did that could have hurt us.

For example, he pushed us to deposit the earnest money before we were legally required to. He also suggested we release the earnest money directly to the sellers, rather than hold it in escrow. And he pushed us to lift our contingencies before our agreed upon deadline.

I didn’t agree to any of these things because there was no reason to: the seller couldn’t unilaterally cancel once we were in contract. Yet the agent was basically trying to push us to lock ourselves in irreversibly even though there was no upside to us for doing so. (Upside for him, perhaps, but not us.)

It’s also possible the agent lied to us during the process. Maybe there was never actually a $20k-over offer. Or maybe he bent the truth a little regarding other offers he told us about, just so we’d sweeten our own offer and make it the best one for the seller. It’s even possible he shared details of our offer with other parties to get them to up their offers.

I’ll never be sure, but his actions gave me reason to suspect he didn’t always tell me the truth or deal straight with us.

What almost killed the entire deal

One conflict of interest almost tanked the deal. The agent pushed us to lift contingencies early, as I mentioned above, which was particularly annoying because at the time there was a potentially serious condition in the house we were investigating and we were trying to get expert contractor opinions.

The agent said he could save us time by arranging and scheduling contractors to come and do the inspection for us.

We were like, cool, thanks for doing that!

You know what he did?

He called his freaking dad who is a contractor to do the inspection.

Seriously…what the F? Who brings their dad to give an “impartial” opinion?

Even if his dad was impartial, surely he must understand it looks hella shady.

His contractor dad told us, “Oh, it’s not a serious problem at all.” Of course he has incentive to say that. He wants his son to close the sale and earn double commission.

But then his dad also said, “Hey, you should fix this. And my friend can do it for $13,000.”

Are you kidding me?

On top of issuing a clean “bill of health” to close the sale, in the same breath he also says it’s important to fix the issue and his friend just happens to be able to do it for $13k?

To add insult to injury, his agent son wants me to lift contingencies early on top of that?

I don’t think so.

I thanked the dad for his time and threw his recommendation straight into the trash.

Then I called a specialist to get a second opinion. The agent pushed me to lift contingencies again. This time I was blunt and called him out and told him that calling his contractor dad to do an inspection in the first place was an unacceptable conflict of interest, unethical, inappropriate, and I would never lift contingencies early no matter what.

The specialist couldn’t schedule an appointment on such short notice before the contingency deadline, so I ended up just sending him photos of the issue and talking on the phone with him.

He affirmed that, based on the photos, the issue was not a deal-breaker, and nothing bad would happen if I ignored the issue, and it would not get worse over time. But he said fixing it the right way would cost about $28k; there was no way to do it for $13k and he explained why step by step.

The $13k price from the dad’s friend was just some dude off the street who wasn’t a specialist in this type of repair.

I told the agent I could withstand up to $20k in unexpected repair costs but, since the issue hadn’t been disclosed in the disclosure reports, despite being obvious, I would need a credit back for the $8k excess the specialist quoted me in order to close the deal.

He pushed back (of course), saying his dad’s friend would do it for $13k, at which point I started getting impatient. I told him if he didn’t understand that I would never, ever even remotely consider hiring his dad or friend for the job, then we should part ways and call off the deal now.

We went back and forth but eventually the agent agreed to credit me back $7k to bridge the difference. It was a hard negotiation, but an important one. That’s what finally got us over the finish line and lifted our contingencies. We went ahead and at closing we got a $7k check back.

Throughout my interactions with him, I learned that when the agent is on both sides of the transaction, you have to be super skeptical about what they tell you.

There are conflicts of interest everywhere, and he may be incentivized to position or message things in a way that isn’t “the truth, the whole truth, and nothing but the truth.” So it’s all on you to do your own diligence and verification, because the agent in this situation won’t have your back.

They have a strong incentive to close the deal when both commissions are at stake. By contrast, your interest is in getting a good value house and not buying a property with fatal flaws.

So just know that if you decide to use the seller’s agent to represent you as a buyer, you may get certain advantages because the agent is motivated to nudge your offer harder. But you also have to push back firmly and liberally when things don’t feel right…and they will most likely not feel right at some point during the deal.

In the end, I simply focused my decision on whether I wanted the property, warts and all, based on the price and conditions we originally offered. As long as the numbers worked, with warts and all factored in, the answer was yes.

The numbers worked, so we closed the deal.

Up next: checklist of critical to-do items before closing to minimize rental vacancy

Next up, I’ll talk about the key tasks we did while waiting to close so that, once the deed transferred, we could hit the ground running, bring remodeling contractors in the very next day, and minimize rental vacancies.

Remember, time is money, so knowing how to get organized in those precious few days/weeks before closing is critical to managing the property efficiently and effectively and minimizing downtime.

Check out all the posts in this series:

- House Hacking San Francisco Bay Area style (how we’re creating real estate wealth by having others pay our mortgage on a multi-million dollar house)

- How to research real estate markets (the single best resource you need)

- How to do a residential property inspection step by step (what smart real estate investors look for)

- You are here: How to write an offer to purchase a house (that stands out and wins)

- How to minimize rental vacancy before you close on a new rental property purchase

- How to find and vet good contractors like a boss (for home remodeling and repairs)

- Battle-tested home remodeling tips for saving serious money and getting the most from your contractors

- How to find great tenants for your rental property in 4 simple steps that take 1 hour or less

Plus: make sure you think about your real estate tax strategy from the very beginning. Check out my post on how to avoid capital gains taxes when selling your house to get up to speed.

Also: learn from some of the best real estate investors in the business from our post: 18 real estate investors share what they wish they knew at college graduation.

Leave a Reply