K and I recently bought an investment property to house hack. This is the 5th post of a new series on strategy and tactics for how to house hack in an expensive market, using our own example as a case study.

In the last post, I shared best practices for making your offer stand out, even if you’re not the high bidder.

I showed how to position your offer to owner-occupier sellers vs. investor sellers, how to add personal touches to your offer, how to get an edge by hiring the seller’s agent (and protect yourself from conflicts of interest).

What happens when your offer is accepted? What should you do before closing to minimize rental vacancy?

Once your offer is accepted, you’re officially in contract and the clock is now ticking down to your closing date.

You may only have a few weeks before closing, so you have a lot of stuff to get done before then. As a new landlord, there are three key things you have to do as quickly as possible:

- Finalize your loan

- Estimate and schedule remodeling work (as efficiently as possible)

- Set up systems, processes, and legal docs to manage your property like a business

Ideally, you want to be able to start renting units out right away after you close, or at least be able to start remodeling right way.

Finalizing your loan

In the most competitive markets, you’ll have to get pre-approved for a loan before you even start writing offers (if you’re not paying cash).

So assuming you got pre-approved, there isn’t actually a lot of work to do to finalize your mortgage after your offer is accepted.

You have to send updated financials, pay stubs, bank statements, etc, to your bank. You also have to do a property valuation appraisal, which can take 1-2 weeks to schedule and then another few days to deliver the appraisal report.

But besides sending these to your bank, it’s just a waiting game to get your loan finalized and scheduled for funding. That’s straightforward.

Estimating and scheduling remodeling work

Your biggest job between accepted offer and closing is estimating and scheduling any remodeling work / repairs needed. The goal is to get remodeling work prioritized and done as efficiently as possible.

I’m going to spend the bulk of this post on this, because it has the most “moving parts” and interlocking dependencies.

Here is the process I recommend for getting this done as painlessly as possible:

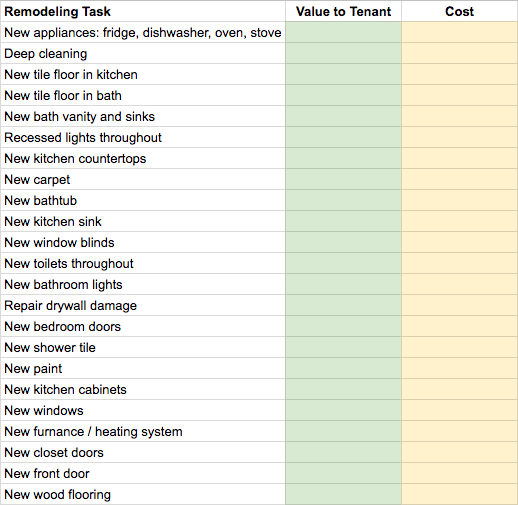

1. Prioritize your remodeling “wish list.” Make a laundry list of ALL the remodeling work you ideally want done. Don’t hold anything back. It should be a remodeling dream list.

List each remodeling item on a separate row in a spreadsheet. Label two columns next to it, one for “cost” and the other for “value to tenant,” like this:

Next, for each remodeling task, come up with “values” for both columns. You can use “T-shirt” sizes for now since you’re just trying to get a rough idea.

But how do you know whether a thing is high/large vs. low/small value to a tenant?

Simple. Just ask yourself, “If I was a tenant deciding whether to rent this unit, would having vs. not having this thing be a deal-breaker? At a minimum, would it heavily influence my decision?”

If the answer is yes, then it is high value to a tenant.

Imagining yourself in the tenant’s shoes is the best litmus test for deciding whether something is high value to tenants. After all, if you wouldn’t be willing to live there, why would another high-quality tenant be willing to?

After you have some swag estimates filled in, sort your list. I recommend sorting by “value to tenant” first. Then sort by “cost.”

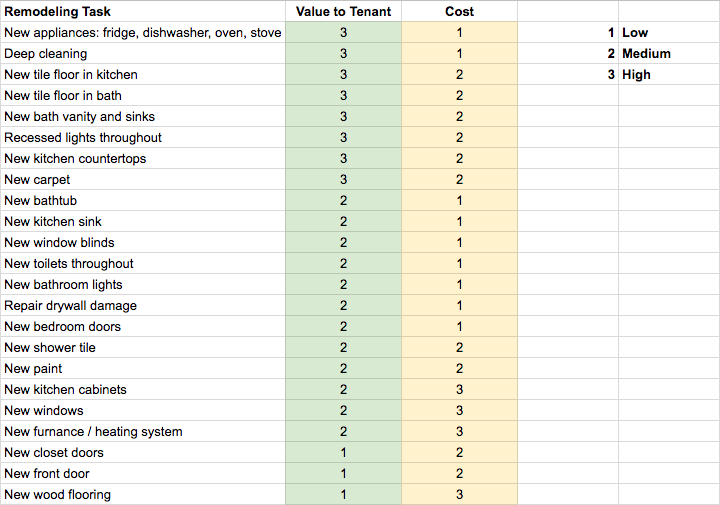

It might look like this:

Remodeling cost-effectively is all about prioritization. By forcing yourself to write down your full wish list, and then assigning and sorting values to assess bang for buck, you’re keeping yourself honest about what is a “must have” vs. “nice to have.”

For me, the “value to tenant” generally must be equal to or greater than “cost” to ultimately make the cut. What I prioritize most highly are remodeling tasks with high value to tenant but low cost/complexity. Upgrading new carpets is a good example of this.

2. Find and vet contractors like a boss. Remember how I recommended before to record video and take lots of photos when you visit the property? Hopefully by the time your offer is accepted, you have these videos and photos ready to go.

Now it’s time to use these media assets to get a head start (read: save time) on getting cost estimates from remodeling contractors.

Actually, if you are really serious about a property, I even recommend gathering cost estimates the moment you have the video/photos, and not even waiting to submit your offer. If you are sure you want to go all in, there’s no time to lose.

But how do you find the right contractors? And how do you vet them?

Well, I just released a companion post on these exact questions – check it out (I’ll wait):

How to find and vet good contractors like a boss (for home remodeling and repairs)

…

..

.

OK, if you read the post above, then you now know my step-by-step framework for finding, vetting, and getting rough cost estimates from contractors.

Once you have rough estimates, you can refine your original spreadsheet list and re-sort it; again, I recommend sorting by “value to tenant” first, then sorting by “cost.”

With this insight, you’ll now be in a much better-informed position to prioritize remodeling tasks and invite “finalist” contractors in to give formal bids.

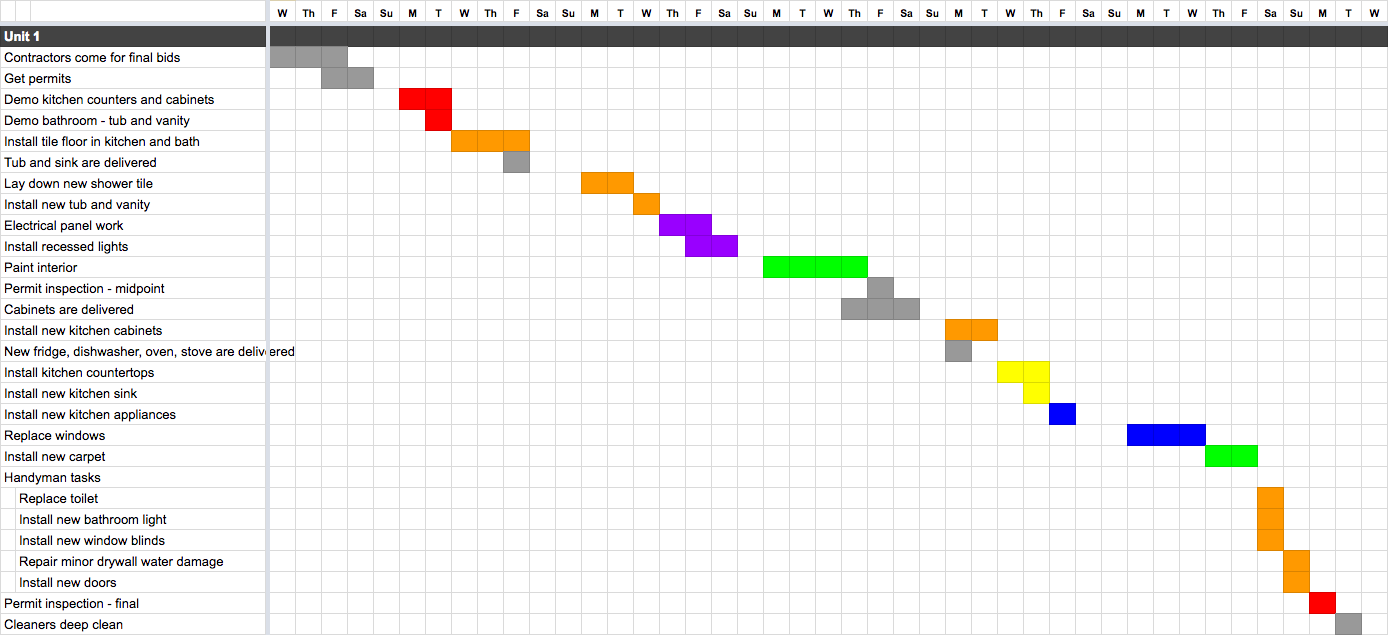

3. Start scheduling. After you decide which contractors to hire for each remodeling task, it’s time to schedule the work.

Scheduling can quickly become very complicated, especially if you are dealing with more than 3-4 contractors and you want to pack the days as much as possible to minimize rental vacancy.

You might be tempted to hire a general contractor or a company that has a staff project manager who can manage the schedule for you. But this usually means your project will cost a premium because their salaries must be paid, and ultimately they’re going to be paid by you.

Even worse, if a middleman handles your scheduling, you will almost certainly NOT get the most efficient schedule possible. The project manager is very unlikely to schedule contractors back-to-back, which makes it unlikely you can minimize rental vacancy.

Why: because a middleman is trying to manage your expectations. That is their job. They want to underpromise and overdeliver. They’ll tell you a project will take 3 months but they actually think it will take two months. If they’re running behind, they don’t need to apologize, because they’ve already added buffer time. If they’re running ahead, it’s a nice bonus surprise for you.

Thing is, if you had scheduled / managed the work yourself, you might be able to finish in 4-6 weeks!

But wait, isn’t it in a general contractor’s own interest to schedule as efficiently as possible? After all, they’re (generally) not getting paid by the hour. They’re getting paid by the project. You’d think they want to finish as fast as possible so they can get to the next job and make more money.

True. But keep in mind they also want to avoid having their workers be idle or pissing their customers off because they finish the job late. These are often even more important to them.

Often one contractor’s work depends on the contractor before them finishing up on time. If the guy before them does NOT finish on time, then the next contractor will be idle. They’re still getting paid by the general contractor, mind you, but they may not actually be able to do any work.

A similar tricky situation is when a contractor’s work depends on materials being ready and available by the start date. If you are hiring someone to install tile or mount new kitchen cabinets, and you are purchasing the materials yourself (because it’s cheaper), then any delay in shipment/delivery means your contractor might not have anything to do on their start date.

To reduce these risks, general contractors tend to schedule plenty of buffer time to ensure their workers are not idle…even if that means days when your rental property annoyingly sits empty and no one is working on it.

This doesn’t mean the general contractor is losing any money/work. They typically have several projects going on at any time. If it turns out they scheduled insufficient buffer time and they’re now facing an idle worker situation, they can simply send that worker to work at a different project site. (They can also pull workers from other project sites to work on your unit.)

The net result is their workers stay busy, but your unit might sit empty random days here and there. To the general contractor, it doesn’t matter because you already awarded them the job and they know they’re gonna get paid for it.

Therefore, it doesn’t matter if it takes an extra two weeks or month to finish because their workers can always be moved around to where they’re needed, like pieces on a chessboard.

Plus, if they told you in the beginning that your project would take three months, and they secretly intended two months, and it ultimately took 10 weeks, you’re still happy because they technically finished ahead of schedule…even though you might have been able to finish in 7 weeks yourself.

At least, that’s true for me. Because I’m an organized guy. I’m good at staying on top of large complex projects.

When you outsource to a project manager / general contractor, you also don’t learn anything. Especially if it’s your first time remodeling, going through the process yourself can be a great teacher, even if it’s painful.

But self-managing/scheduling isn’t for everyone. It takes time, strong organizational and analytical skills, a great deal of patience, and the ability to change schedules quickly when circumstances change. Oh, and always communicating proactively and clearly back to all stakeholders.

But if you do it yourself, how do you prevent situations where a contractor is scheduled to start, but the guy before him didn’t finish on time? And how do you prevent situations where materials aren’t delivered on time? That’s where continuous, near-obsessive monitoring of your schedule / progress is critical.

When I remodeled the 4-plex, I reviewed my master schedule timeline every single day. Usually multiple times. At the end of each day, I checked in with the contractors to see the progress and get feedback on whether the job was still on track. This provided day by day insight on progress and velocity.

It also allowed me to adjust things in a very agile fashion. Every day I analyzed whether my project schedule needed to be changed based on that day’s progress (or lack of progress). Maybe a contractor was taking too long and was now unlikely to finish on time. Maybe they were actually moving faster than expected and were now likely to finish early. Maybe crucial materials were getting delivered earlier or later than expected.

If any contractors needed to be adjusted based on that day’s events, I would quickly shift around blocks on my timeline like Legos.

Then I immediately emailed and texted impacted contractors to request the schedule changes. Sometimes they agreed without objection; other times I’d have to adjust things again to make my schedule work with theirs. I did factor in a little bit of buffer as well, but much less than a general contractor would.

But again, it takes real work to do all this. Not everyone has the desire to stay on top of everything themselves. But for those who do, it can save money, because you cut out the middleman. It also means you’ll likely finish faster. And that helps minimize rental vacancies.

What if you could start remodeling even BEFORE you close the transaction?

Say you already have your remodeling plans finalized. You know exactly which contractors you’ll use. Can you get a head start (read: save time and money) by starting remodeling even before you officially close the purchase?

Possibly. But it gets tricky. And bottom line, it comes down to negotiating it with the seller.

First, it’s risky. If your contractors start tearing down walls before you close, and then something goes wrong with the transaction, what happens then? Maybe your loan falls through. Maybe you discover something wrong with the house. Maybe the house catches fire.

Whatever it is, once you start investing in remodeling, you increase the risk if something goes wrong with the deal (on top of your earnest money).

Second, some states may not even let you remodel before closing. When a state does NOT follow the common law principle of “equitable conversion,” you will not be able to start remodeling before closing.

Under the principle of equitable conversion, a buyer becomes the legal owner of title to the property the moment you go into contract. The seller merely becomes the legal owner of the cash sale proceeds. Both parties have possession of the other’s property but no longer actually own it. They’re just waiting for the transaction to close so they can trade possession.

Therefore, when a state follows the principle of equitable conversion, the buyer theoretically has the right to begin remodeling before the transaction closes, because they are the legal owner of title to the property, even if they don’t have possession (again, assumes there is a binding contract).

However, even if your state follows this legal principle, it still might not be possible to remodel before closing. The seller may need to continue living in the house because they need the sale proceeds to buy their next house. Or they may not have lined up their next living situation yet, in which case they’re requesting a lease-back as a condition of the sale.

Finally, even if the house is vacant, it’s very possible the seller has never heard of “equitable conversion.” You may need to educate them. Even after you educate them, they might not feel comfortable with you going in and demoing stuff and moving walls around before they get their money.

In other words, even if you have the legal right, it may cost you more in time, energy, and even legal fees to enforce your right to remodel than is worthwhile. At most you only get a few weeks head start. Is it really worth destroying the seller relationship by going all legalistic?

So, how can you remodel early then?

The best way, if the property is vacant, is to simply ask the seller: “I have a big remodeling job to do on the place, and now that we’re in binding contract and you have my earnest money, we’re just waiting to close, so the deal is as good as done. Are you OK if I start remodeling a little early so I can save some time once we close?”

Or something like that.

They might say no. No big deal. But they might also be open to it and say yes. In which case you save some time.

The point is, it’s all a negotiation. And it’s worth asking in a casual, friendly, non-legalistic way. The worst they can say is no.

On the other hand, if they agree, make sure to (gently) get it in writing so you protect yourself if any trouble arises later on.

You can just send a short follow up email to the seller: “Hey, just confirming you’re cool with me starting to remodel tomorrow. I’ll be demoing the kitchen counters and divider wall, repainting, changing carpets, and changing windows. Could you confirm you’re on board with that?”

In general, it’s probably safer to assume you cannot start remodeling early. But if you are able to get the seller to agree, and you’re comfortable doing it, it can actually save a lot of time.

Depending on how long your closing period is, you can get several weeks or even more than a month head start. If you’re lucky and things go smoothly, it could mean potentially having the unit available to rent the moment the transaction closes, shrinking your vacancy to zero.

Set up your property management system

To run your rental properties professionally like a business, you’ll want to set up some kind of property management system. At a minimum, I suggest:

1. Standardized forms for routine interactions. Google around for examples of standard rental applications, property damage checklists, move in / move out checklists. You’ll need these pretty quickly once you start screening tenants and signing leases. Since these type of forms already exist widely, just search online to find standard ones you can use right away. No need to re-invent the wheel here.

2. Templates for key legal documents. Think: leases, lease extensions, house rules, notices for things like unit entry, termination notices, rent increase notice, utility bill back notice, rent payment and deposit receipts, etc. (Also, while not a legal template, it’s also useful to have canned advertising copy ready to go, so you can just copy-paste to Craigslist and other websites once you’re ready.)

If you don’t have any legal templates ready to go, you can start by searching online for examples. But be sure to actually read them carefully. Don’t just take them at face value. Very often there will be provisions in templates found online that are not appropriate for your property or that don’t follow the laws of your state or city.

The best approach is to gather a bunch of templates online, then heavily merge, edit, and adapt them to your specific needs and situation, including local laws in your area. In some cases, you may need to substantially redraft the entire document to fit your needs.

3. A way to track financial performance of your properties. Even if it’s just using simple spreadsheets to start, I urge you to set up a structured way to track your property’s income and expenses. To keep things simple, use a Google spreadsheet at the very beginning; if you only have a few properties, you probably don’t need fancy software yet.

Whether you use a spreadsheet or software, the key things to record are rental income and costs. You want insight on how much cash your property is actually generating.

Costs include operating expenses like utilities, gardening, or other recurring expenses; it also includes maintenance (normal repairs), insurance, property taxes, plus any amortized capex expenses (which you would be wise to provision for each month).

Anything left over is “net operating income,” or NOI, which can be used to pay down mortgage debt if you took out a loan.

How to think about setting up a scalable system

Ideally, you should start thinking about systematizing stuff from Day 1. This will help you manage your properties as efficiently as possible.

My general rule is, I try to avoid repeating the same work twice. If there is a task I find myself repeating twice, a little switch goes off in my head nudging me to consider standardizing / systematizing that task.

In practice, this could mean anything from:

- Building a little spreadsheet tool or model (if it involves repetitive calculations)

- Writing stuff down into a reusable template so I can copy-paste next time

- Creating a library of photos, videos, or graphics to reuse

- Setting up email filters and autoresponders to automatically send canned responses

- Or even just writing down the exact steps to complete the task, so if I get hit by a bus, someone else can do the same task simply by reading my instructions, even if they lack context (this also allows me to outsource)

In special cases, if it’s something especially tedious and repetitive but valuable, I may even write a little software program (requires basic coding skills) to help me automate.

For example, if I need to constantly check online what local rents are going for, I might write a little tool that periodically scrapes Craigslist, Zillow, Trulia, Hotpads, etc, and automatically generates a list of local rents for me.

Once you have more than a few properties, or if you simply want to systematize things from the start, consider using dedicated software to help manage your properties.

There are various paid software tools out there (e.g., Buildium), but if you are just starting out, I recommend keeping it simple and using a free product like Cozy, which should have everything you need to start.

Regardless of what tool you use, property management software generally helps you:

- Collect rental applications online

- Screen potential tenants via credit reports and background checks

- Digitally sign leases and other docs

- Collect rent payments online

- Track maintenance requests and tenant communications

- Track and organize operating expenses

- Export data to spreadsheets or tax/financial software

You don’t need an industrial strength tool if you’re just managing a few properties, but beyond that it can help you manage your time more effectively.

Conclusion

Bottom line is, once you are in contract and waiting to close, there’s plenty of stuff you can do to get a head start on getting the property rent-ready to minimize vacancy time.

Finalizing your loan docs is just a minor part. That’s because, if you’re purchasing in a competitive market, you’ll most likely have to get pre-approved or pre-underwritten before you even start bidding.

By contrast, you can save a LOT of time by “parallel processing” while you wait to close: vet and schedule contractors for remodeling (or even have them start work before closing), and set up the right amount of property management systems/process that works for you.

By doing this, you may even find yourself ready to rent out your property the moment you close!

Next, I’ll share some powerful strategies for finding and vetting good contractors like a boss.

Check out all the posts in this series:

- House Hacking San Francisco Bay Area style (how we’re creating real estate wealth by having others pay our mortgage on a multi-million dollar house)

- How to research real estate markets (the single best resource you need)

- How to do a residential property inspection step by step (what smart real estate investors look for)

- How to write an offer to purchase a house (that stands out and wins)

- You are here: How to minimize rental vacancy before you close on a new rental property purchase

- How to find and vet good contractors like a boss (for home remodeling and repairs)

- Battle-tested home remodeling tips for saving serious money and getting the most from your contractors

- How to find great tenants for your rental property in 4 simple steps that take 1 hour or less

Plus: make sure you think about your real estate tax strategy from the very beginning. Check out my post on how to avoid capital gains taxes when selling your house to get up to speed.

Also: learn from some of the best real estate investors in the business from our post: 18 real estate investors share what they wish they knew at college graduation.

Leave a Reply